Risk Management in Trading: Safeguarding Financial Success

Introduction

Risk management is a cornerstone of successful trading, serving as the defense against the volatility and uncertainties of financial markets. Whether trading stocks, forex, commodities, or cryptocurrencies, the ability to identify, assess, and mitigate risks is crucial for sustaining profitability and avoiding catastrophic losses. This article explores the principles, tools, and strategies essential for effective risk management in trading.

1. Understanding Risk in Trading

Risk in trading refers to the potential for loss due to adverse market movements. Every trade carries inherent risks, including:

- Market Risk: The possibility of losing money due to unfavorable price movements.

- Liquidity Risk: The inability to execute trades at desired prices due to insufficient market liquidity.

- Leverage Risk: Amplified losses resulting from borrowed capital used in leveraged trading.

- Operational Risk: Risks arising from technical issues, system failures, or human errors.

Understanding these risks is the first step in building a robust risk management framework.

2. Setting Risk Tolerance

Risk tolerance varies among traders based on their financial goals, capital base, and psychological comfort with losses. Establishing a risk profile helps traders define:

- Maximum Loss Per Trade: A predefined percentage of the trading account (commonly 1-2%) that a trader is willing to risk on a single trade.

- Portfolio Drawdown Limits: A cap on the maximum percentage loss a trader can tolerate across their portfolio over a given period.

Traders should periodically reassess their risk tolerance to align with changing market conditions and personal circumstances.

3. Importance of Position Sizing

Position sizing determines the number of units or contracts to trade based on risk tolerance and market conditions. Proper position sizing ensures that no single trade disproportionately impacts the trading account. Key methods include:

- Fixed Fractional Sizing: Allocating a fixed percentage of the account to each trade.

- Volatility-Based Sizing: Adjusting position size based on market volatility, using indicators like Average True Range (ATR) to calculate stop-loss distances.

Position sizing tools and calculators are widely available to aid traders in implementing this strategy.

4. Using Stop-Loss and Take-Profit Orders

Stop-loss and take-profit orders are essential tools for managing risk and locking in profits.

- Stop-Loss Orders: Automatically close a trade at a predetermined price level to limit losses. These can be static or dynamic, such as trailing stops.

- Take-Profit Orders: Automatically close a trade when a target profit level is reached, ensuring gains are realized before the market reverses.

Combining these orders with careful analysis can significantly enhance a trader’s risk-reward profile.

5. Diversification and Hedging

Diversification involves spreading investments across various assets, sectors, or markets to reduce risk. By diversifying, traders mitigate the impact of adverse movements in any single asset. For example:

- Investing in uncorrelated asset classes like equities and bonds.

- Trading in multiple currency pairs or commodities to reduce dependence on a single market.

Hedging, on the other hand, involves taking offsetting positions to protect against potential losses. Common hedging strategies include:

- Using options to limit downside risk.

- Employing futures contracts to lock in prices.

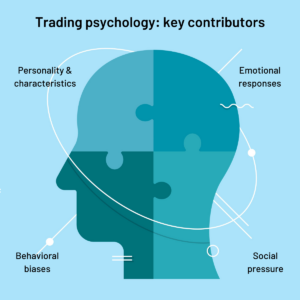

6. Psychological Aspects of Risk Management

Trading psychology plays a pivotal role in effective risk management. Emotional responses like fear and greed can lead to impulsive decisions and overexposure to risk. To maintain discipline:

- Stick to the Plan: Follow a well-defined trading plan that includes entry, exit, and risk management rules.

- Accept Losses: View losses as a natural part of trading rather than a personal failure.

- Avoid Overtrading: Resist the urge to chase losses or overextend positions after a winning streak.

Journaling trades and reflecting on decisions can also help traders refine their psychological approach.

7. Leveraging Technology and Tools

Modern trading platforms and tools offer robust features for managing risk effectively. These include:

- Risk Analytics Tools: Provide insights into portfolio exposure and potential drawdowns.

- Automated Trading Systems: Execute trades based on pre-set criteria, reducing emotional biases.

- Market Alerts: Notify traders of significant price movements or technical patterns.

Using these tools can streamline risk management processes and enhance decision-making.

8. Adapting to Market Conditions

Markets are dynamic, and risk management strategies must evolve to remain effective. Traders should:

- Monitor Economic and Geopolitical Events: Stay informed about factors that can influence market volatility.

- Adjust Strategies: Adapt trading plans based on changes in market trends or personal financial circumstances.

- Reevaluate Portfolio: Regularly review and rebalance portfolios to ensure alignment with risk tolerance and goals.

Conclusion

Risk management is not merely a defensive measure; it is a proactive strategy that enables traders to navigate the uncertainties of financial markets with confidence. By understanding risks, setting clear limits, diversifying investments, and leveraging technology, traders can protect their capital and position themselves for long-term success. Ultimately, disciplined risk management transforms trading from a speculative gamble into a structured and sustainable endeavor.