Understanding the Surge in Personal Spending

The recent report on the United States Personal Spending Month-over-Month (MoM) has unveiled a significant jump, with actual spending at 0.7%, surpassing both the previous month’s 0.6% and the forecasted 0.5%. This 16.667% increase highlights robust consumer confidence and potentially signals a ripple effect on both domestic and international markets.

Implications for the United States and the Global Economy

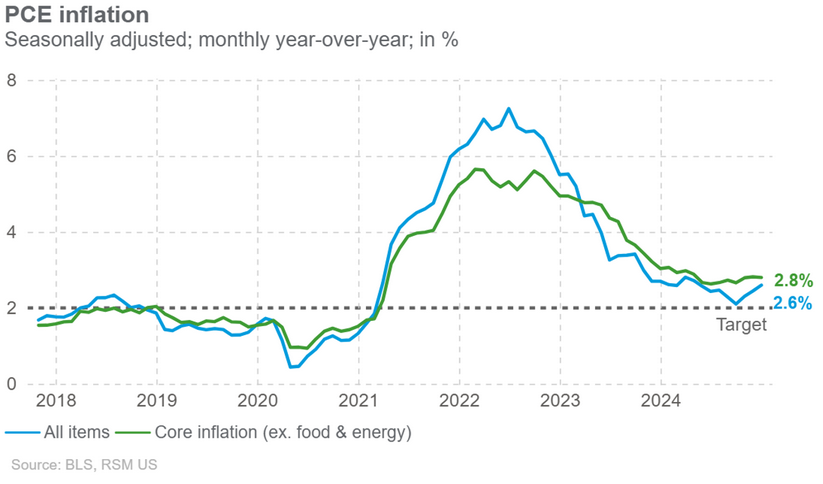

This substantial rise in personal spending reflects increased consumer confidence, potentially translated into higher GDP growth for the US economy. In tandem, it raises inflationary pressures, prompting the Federal Reserve to reassess monetary policies to prevent the overheating of the economy.

Globally, increased US consumer spending typically indicates a stronger demand for goods and services, which could boost international trade. However, it also poses a risk of importing inflation into other countries, particularly those with weaker economies or higher dependencies on US markets.

Investment Opportunities Sparked by the Surge

With high market impact, the jump in US personal spending presents numerous investment opportunities across various asset classes. Traders and investors should consider these five top symbols for each category:

Best Stocks to Trade

- AMZN (Amazon.com Inc.): Directly benefits from increased consumer spending, especially in retail.

- AAPL (Apple Inc.): Gains as higher disposable income fuels demand for tech products.

- WMT (Walmart Inc.): Likely to see revenue growth with enhanced consumer expenditure.

- F (Ford Motor Company): Increased spending may drive automobile purchases.

- NKE (Nike Inc.): Beneficiary of heightened consumer interest in premium lifestyle goods.

Best Exchanges to Trade

- NYSE: Home to blue-chip stocks which benefit from higher spending trends.

- NASDAQ: Tech-heavy exchanges are poised to gain from consumer demand in electronics.

- CME (Chicago Mercantile Exchange): Trades futures contracts that could benefit from increased spending.

- ICE (Intercontinental Exchange): Offers diverse financial products sensitive to economic indicators.

- EURONEXT: Volatility due to US spending can lead to arbitrage opportunities across global markets.

Best Options to Trade

- SPY (S&P 500 ETF): Options could capitalize on upward market momentum.

- QQQ (NASDAQ-100 ETF): Volatility plays on tech-heavy markets.

- VIX (CBOE Volatility Index): Anticipating potential market fluctuations due to monetary policy adjustments.

- XLF (Financial Sector ETF): Financials may lead gains with improved economic outlook.

- EWZ (iShares MSCI Brazil ETF): Captures international effects of US economic strength.

Top Currencies to Trade

- USD/EUR: Reflects US economic strength; could appreciate against the Euro.

- USD/JPY: Potential strengthening of the USD impacting trade dynamics.

- GBP/USD: Volatility driven by US economic data can offer trading opportunities.

- AUD/USD: Sensitivity to commodity demands driven by Rising US consumption.

- USD/CAD: Reflects North American trade interdependencies and oil price impacts.

Top Cryptocurrencies to Watch

- BTC (Bitcoin): Interest can surge as a hedge against inflationary trends.

- ETH (Ethereum): Gains traction with increased adoption and network use.

- LTC (Litecoin): Known for faster processing times, can be bolstered by increased transactions.

- USDT (Tether): Stablecoin usage can increase as traders seek stability amidst volatility.

- BNB (Binance Coin): Trading volume boosts on platforms may enhance value.

The increase in US Personal Spending sets a stage of both opportunities and challenges, reflecting consumer optimism yet cautioning potential inflationary responses. For investors, navigating these waters with strategic asset allocation could yield significant returns amidst a dynamically shifting financial landscape.