-

- What is a Flag Chart Pattern?

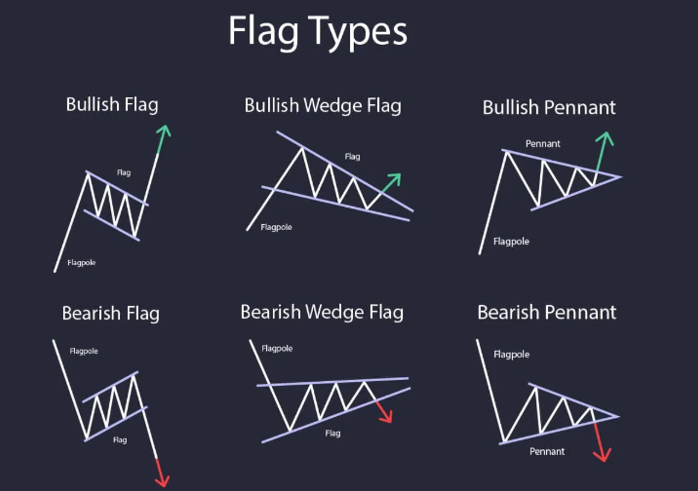

Flag chart patterns are a continuation pattern that signals a brief period of consolidation after a strong price move. It resembles a “flag on a pole” and typically indicates that the trend will resume in the same direction.

The key components of a flag pattern are:

-

- Flagpole: A sharp, strong price movement that forms the initial trend.

-

- Flag: A rectangular consolidation phase, usually moving against the trend, formed by parallel support and resistance lines.

Types of Flag Patterns

1. Bullish Flag

-

- Appearance: Forms after an upward move (flagpole). The flag slopes downward or consolidates horizontally.

-

- Signal: Indicates the continuation of an upward trend.

-

- Trading Strategy: Traders look for a breakout above the flag’s upper resistance line to enter long positions.

2. Bearish Flag

-

- Appearance: Forms after a downward move (flagpole). The flag slopes upward or consolidates horizontally.

-

- Signal: Indicates the continuation of a downward trend.

-

- Trading Strategy: Traders look for a breakout below the flag’s lower support line to enter short positions.

How to Identify a Flag Pattern

-

- Sharp Move (Flagpole): Identify a strong, impulsive price move.

-

- Consolidation (Flag): Look for a brief, parallel, or sloping (consolidation).

-

- Breakout Confirmation: Wait for a breakout in the same direction as the initial move.

Trading the Flag Pattern

-

- Entry:

-

- For a bullish flag: Buy when the price breaks above resistance.

-

- For a bearish flag: Sell when the price breaks below support.

-

- Entry:

-

- Stop-Loss: Place stops below the flag’s support (bullish) or above the flag’s resistance (bearish).

-

- Target: Measure the flagpole length and project it from the breakout point for a price target.

Key Features of Flags

-

- Timeframe: Appears across multiple timeframes.

-

- Volume: Volume decreases during the flag’s formation and increases during the breakout. (Trading View)

-

- Reliability: A highly reliable continuation pattern when properly confirmed.

By recognizing flag patterns, traders can anticipate trend continuations and improve trade entries and exits.

Written by,

Sigmanomics education team