In the world of financial markets, traders engage in various strategies to make profits from the movements of securities. One of the more common strategies is day trading, where a trader buys and sells securities within a single trading day. However, a specific set of rules and regulations govern day trading activity, particularly for those who engage in frequent trading. This article will explore pattern day trading, including its definition, the rules associated with it, how it works, and its impact on traders.

What is Pattern Day Trading?

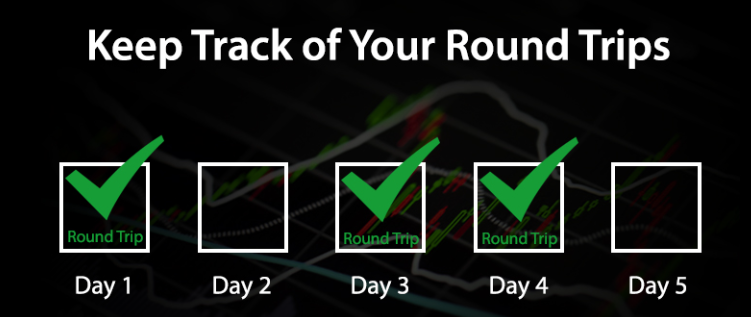

Pattern day trading (PDT) refers to a set of regulations that apply to individuals who engage in day trading on margin accounts. In simple terms, it defines a trader who buys and sells the same security within the same day on at least four occasions during a five-business-day period. A pattern day trader is someone who frequently trades stocks, options, or other securities during the trading day in an attempt to capitalize on short-term price fluctuations.

In the United States, the rules surrounding pattern day trading were established by the Financial Industry Regulatory Authority (FINRA) and enforced by the Securities and Exchange Commission (SEC). These regulations are designed to ensure that day traders who trade on margin have enough capital to cover potential risks, as day trading is often associated with higher levels of volatility and financial exposure.

Rules of Pattern Day Trading

The key rule that defines a pattern day trader is the requirement to make four or more day trades within five business days. However, not all traders are subject to the PDT rules. To determine whether you are a pattern day trader, several criteria are considered:

- Number of Day Trades: A trader must execute four or more day trades in a rolling five-day period. A day trade is defined as the purchase and sale of the same security on the same day, and it can involve stocks, options, or other financial instruments.

- Margin Account: The rules only apply to traders who use a margin account. A margin account allows a trader to borrow funds from their broker to trade larger positions than they could with their own capital. Without a margin account, a trader cannot be classified as a pattern day trader under these rules, regardless of how many trades they execute.

- Minimum Equity Requirement: If a trader meets the pattern day trader criteria, they must maintain a minimum balance of $25,000 in their margin account at all times. This is the minimum equity required by FINRA for pattern day traders. If the account balance falls below this threshold, the trader will be restricted from making further day trades until the account balance is restored.

- Day Trade Buying Power: Pattern day traders are allowed to use leverage in their trading, meaning they can trade with borrowed funds. Typically, the margin requirement is 25% of the total value of the day trade. However, this can vary based on the brokerage and the specific rules they enforce.

How Pattern Day Trading Works

When a trader engages in pattern day trading, they are looking to profit from short-term price movements in securities. They often utilize technical analysis, such as chart patterns, indicators, and other market signals, to time their trades. The goal is to buy low and sell high within the same trading session, taking advantage of volatility.

For example, a pattern day trader might purchase 1,000 shares of a stock at $10 per share early in the day. Later, after the price increases to $12 per share, the trader sells the stock, realizing a profit of $2,000 (ignoring fees and commissions). This cycle could be repeated several times in a day, making up the day trades that define pattern day trading.

However, the primary challenge of pattern day trading lies in the requirement to have enough capital to meet the margin requirements. The trader’s ability to borrow funds is based on the equity in their account, and if the account balance falls below the required threshold, the trader will be subject to restrictions. This means that traders must be highly disciplined and manage their capital carefully, as failing to meet the margin requirements can result in limitations on their ability to continue day trading.

Impact of Pattern Day Trading Rules on Traders

The pattern day trading rules have a significant impact on how traders approach their activities. The most obvious impact is the minimum equity requirement of $25,000. This rule ensures that traders who engage in frequent day trading have enough capital to manage the risks associated with leveraged trading. For many retail investors, this requirement might be a barrier to entry into the world of day trading, as it can be challenging to accumulate such a large amount of capital, particularly for beginner traders.

Another effect of the PDT rules is the restriction placed on traders whose accounts fall below the $25,000 minimum. If a trader’s account balance dips below this amount, they are prohibited from day trading until the balance is replenished. This can limit the ability of a trader to actively participate in the market, forcing them to either deposit more funds into their account or shift their focus to other types of trading.

Additionally, the pattern day trading rules impact how brokers interact with traders. Brokers are required to enforce the PDT rules by monitoring their clients’ trading activity and ensuring that they meet the minimum equity requirements. For brokers, this can be an administrative burden, as they must track traders’ day trade counts and issue warnings or account restrictions when necessary. However, these rules are designed to protect both the broker and the trader from the financial risks of excessive margin trading.

Advantages and Disadvantages of Pattern Day Trading

Like any form of trading, pattern day trading has both advantages and disadvantages.

Advantages:

- Profit Potential: Day trading offers the potential for significant profits in a short amount of time. By capitalizing on small price movements, traders can generate substantial returns in a single day.

- Liquidity: Day trading typically involves highly liquid stocks or assets, which allows for the quick execution of trades. This can be advantageous for traders looking to enter and exit positions swiftly.

- Leverage: The ability to trade on margin means that traders can use borrowed funds to amplify their potential gains. This leverage can result in higher returns on successful trades.

Disadvantages:

- High Risk: Pattern day trading is inherently risky. The volatility of the market means that significant losses can accumulate quickly, particularly if a trader is over-leveraged.

- Minimum Equity Requirement: The $25,000 equity requirement can be a substantial barrier for many retail traders. This forces individuals to either have a significant amount of capital or to abandon day trading as a strategy.

- Stress and Time Commitment: Day trading requires constant monitoring of the markets, which can be mentally and emotionally taxing. Traders must stay focused for long hours, especially when dealing with fast-moving markets.

Conclusion

Pattern day trading is a strategy employed by traders who seek to profit from short-term price movements in securities. It is characterized by frequent trades, often within the same day, and requires significant capital and margin accounts. The regulations surrounding pattern day trading, such as the $25,000 minimum equity requirement, are designed to manage the risks associated with this high-risk form of trading.

While day trading offers opportunities for profit, it also presents significant challenges. The rules governing pattern day trading aim to protect traders and brokers from the financial risks associated with excessive leverage, but they can also limit access to this trading style for individuals without the necessary capital. For those who choose to engage in pattern day trading, a clear understanding of the rules and strategies is essential to navigate the complexities of the market successfully.