Are lawmakers too cautious, or is Bitcoin’s instability genuinely too risky for state-backed investments?

Bitcoin, the world’s first and most well-known cryptocurrency, has been making waves in the financial world for over a decade now. Its decentralized nature, limited supply, and potential for huge returns have attracted investors from all walks of life. However, as more and more institutions begin to embrace Bitcoin, the question arises: are lawmakers being too cautious about allowing state-backed investments in this digital asset, or is Bitcoin’s intrinsic instability truly too risky for such investments?

The Case for Caution

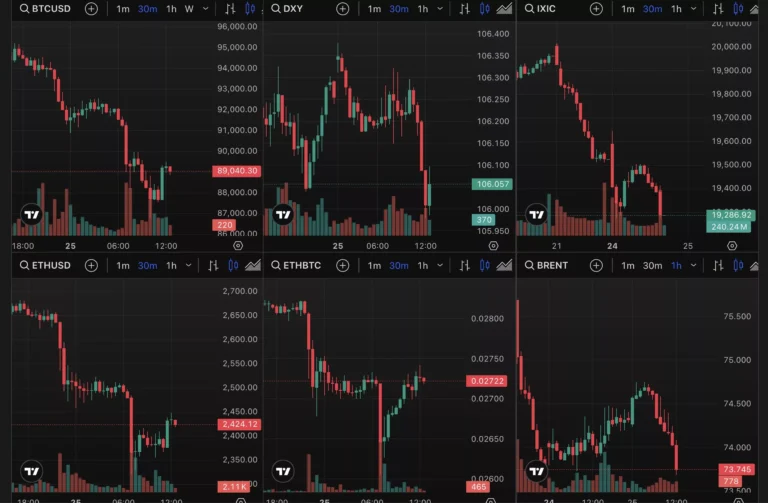

On one hand, it’s easy to see why lawmakers might be hesitant to allow state-backed investments in Bitcoin. The cryptocurrency market is notoriously volatile, with prices swinging wildly on a daily basis. This level of instability could pose a significant risk to public funds, especially in a time when governments are dealing with economic uncertainty brought on by the COVID-19 pandemic.

Additionally, the lack of regulation in the cryptocurrency space means that investors may not have the same protections that they would in traditional markets. This raises concerns about potential fraud, market manipulation, and other illegal activities that could further endanger state funds.

The Case for Embracing Bitcoin

On the other hand, proponents of state-backed investments in Bitcoin argue that the potential rewards outweigh the risks. With central banks around the world pumping trillions of dollars into their economies through quantitative easing measures, many fear that traditional fiat currencies could be devalued over time.

Bitcoin, with its finite supply and decentralized structure, offers a hedge against inflation and government interference. By diversifying their investments into this digital asset, states could potentially protect their wealth and even generate substantial returns in the long run.

How This Could Affect You

For the average individual, the debate over state-backed investments in Bitcoin may not seem immediately relevant. However, if governments decide to allocate public funds into this cryptocurrency, it could have ripple effects on the economy and financial markets.

On one hand, increased institutional adoption of Bitcoin could lead to greater price stability and mainstream acceptance, potentially benefiting individual investors who hold the digital asset. On the other hand, any regulatory crackdowns or market crashes resulting from state-backed investments could have negative repercussions on the overall cryptocurrency market.

How This Could Affect the World

From a global perspective, the decision to allow state-backed investments in Bitcoin could have far-reaching consequences. If more countries follow suit and add this cryptocurrency to their official reserves, it could signal a major shift in the financial landscape.

This move could either legitimize Bitcoin as a mainstream asset class or expose its vulnerabilities to manipulation and regulatory scrutiny. Either way, the outcome will likely shape the future of cryptocurrencies and their role in the global economy.

Conclusion

As lawmakers weigh the risks and rewards of state-backed investments in Bitcoin, it’s clear that this decision has the potential to reshape the financial world as we know it. While caution is certainly warranted given the volatility and uncertainty surrounding this digital asset, the potential benefits of diversifying into Bitcoin cannot be ignored.

Ultimately, whether lawmakers are too cautious or Bitcoin is genuinely too risky for state-backed investments remains to be seen. Only time will tell how this debate plays out and what impact it will have on individuals, governments, and the world at large.