Trump’s Tariffs: A Catalyst for Rising Inflation and Economic Uncertainty

In recent months, President Donald Trump’s administration has implemented a series of tariffs targeting imports from major trading partners, including China, Canada, and Mexico. These protectionist measures have ignited debates among economists, policymakers, and consumers regarding their potential impact on the U.S. economy, particularly concerning inflation rates and overall economic stability.

The Inflationary Impact of Tariffs

Tariffs function as taxes on imported goods, leading to increased costs for businesses that rely on these imports. Consequently, companies often pass these additional expenses onto consumers, resulting in higher retail prices. Federal Reserve Chair Jerome Powell has acknowledged this effect, stating that President Trump‘s trade policies, including the imposition of tariffs, are contributing to higher inflation and potentially delaying progress on lowering it further.

The Federal Reserve has adjusted its economic forecasts in response to these developments. The Fed cut its 2025 GDP growth forecast from 2.1% to 1.7% and projected 2026 growth at 1.8%, influenced by trade levies and economic uncertainties. Consumer price inflation is expected to rise from 2.5% to 2.7% in 2025 before decreasing to 2.2% in 2026.

Economic Growth and Stagflation Concerns

The introduction of tariffs has raised concerns about the potential for stagflation—a scenario characterized by stagnant economic growth coupled with high inflation. Economists warn that these tariffs could lead to a recession if not managed carefully. Some suggest the situation is reminiscent of the 1970s stagflation era, requiring cautious and timely monetary responses from the Fed.

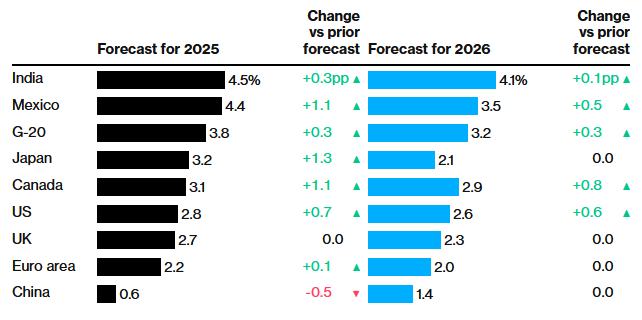

The Organisation for Economic Co-operation and Development (OECD) has also expressed apprehension, forecasting that President Donald Trump’s tariff hikes will reduce economic growth in Canada, Mexico, and the United States, while increasing inflation. This anticipated growth reduction prompted the OECD to lower its global economic outlook, predicting global growth will slow to 3.1% in 2025 and 3.0% in 2026.

Consumer Impact and Market Reactions

American consumers are likely to experience the direct effects of these tariffs through increased prices on a wide range of goods. Analyses suggest that the tariffs could cost the average American household $800 annually. Furthermore, the tariffs may force companies to move manufacturing out of the U.S., leading to job losses and a decline in American manufacturing.

Market reactions to the tariffs have been mixed. While some sectors may benefit from reduced foreign competition, others face challenges due to disrupted supply chains and increased production costs. The Federal Reserve’s decision to maintain current interest rates reflects a cautious approach amid these uncertainties. The Fed plans two rate cuts in 2025 and another in 2026, despite President Trump’s push for more aggressive rate reductions.

Global Trade Relations and Retaliatory Measures

The imposition of tariffs has strained trade relations with key partners. In response to U.S. tariffs, countries like Canada and China have implemented retaliatory measures, imposing their own tariffs on various U.S. goods. These actions have the potential to escalate into broader trade conflicts, further complicating the global economic landscape.

Conclusion

President Trump’s tariff policies have introduced significant uncertainty into the U.S. economy, with tangible effects on inflation, economic growth, and consumer prices. While the administration asserts that these measures aim to protect domestic industries and reduce trade deficits, the broader economic implications suggest a complex interplay of factors that could challenge both businesses and consumers in the coming months.

Written by,

Sigmanomics Team