Macro concerns overshadow Trump’s crypto announcements

A Closer Look at Tariff-Related Issues

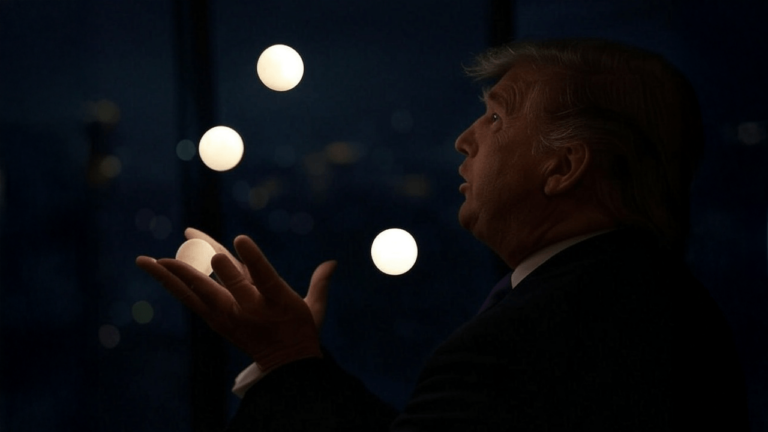

One observer recently noted that macro concerns, mainly tariff-related, have been overshadowing President Trump’s recent announcements regarding cryptocurrency. This observation sheds light on the broader economic landscape in which digital currencies are operating. While the rise of cryptocurrencies such as Bitcoin and Ethereum has captured the attention of the financial world in recent years, larger macroeconomic forces continue to exert significant influence on the market.

The Impact of Tariffs on Crypto

Concerns about tariffs and their potential impact on the global economy have been growing in recent months. President Trump’s trade policies, including tariffs imposed on various countries, have created uncertainty and volatility in financial markets. This uncertainty has spilled over into the cryptocurrency space, as investors seek safe havens for their assets amid economic turbulence.

While the cryptocurrency market is often viewed as a separate entity from traditional financial markets, it is not immune to broader macroeconomic trends. The price of Bitcoin, for example, has been closely correlated with movements in the stock market and other economic indicators. As tariff-related concerns continue to dominate the economic landscape, the crypto market may experience increased volatility and fluctuations.

How This Will Affect You

For individual investors in cryptocurrency, the macroeconomic concerns surrounding tariffs could have a direct impact on the value of their holdings. The increased volatility in the market may lead to rapid price changes, making it difficult to predict future trends. It is important for investors to stay informed about global economic developments and their potential impact on the crypto market.

How This Will Affect the World

On a larger scale, the impact of tariff-related macro concerns on the cryptocurrency market could have ripple effects throughout the global economy. As digital currencies become increasingly integrated into the financial system, fluctuations in the crypto market could have broader implications for international trade and investment. It is crucial for policymakers and industry leaders to consider the interconnected nature of the global economy when formulating trade policies and regulations related to cryptocurrencies.

Conclusion

In conclusion, while President Trump’s crypto announcements may have captured headlines in recent weeks, it is important to remember that larger macroeconomic concerns are at play. Tariff-related issues and their impact on the global economy continue to overshadow developments in the cryptocurrency market. As investors navigate this complex economic landscape, staying informed and vigilant will be key to making sound financial decisions in the future.