Argentina Unveils Managed Float for Peso Amidst $20 Billion IMF Deal: A New Chapter in Economic Reform

In a landmark move signaling a significant shift in Argentina’s economic policy, President Javier Milei’s administration has secured a $20 billion agreement with the International Monetary Fund (IMF) and introduced a managed float system for the Argentine peso. This dual strategy aims to stabilize the nation’s economy, attract foreign investment, and restore confidence in its financial systems.

Transitioning to a Managed Float

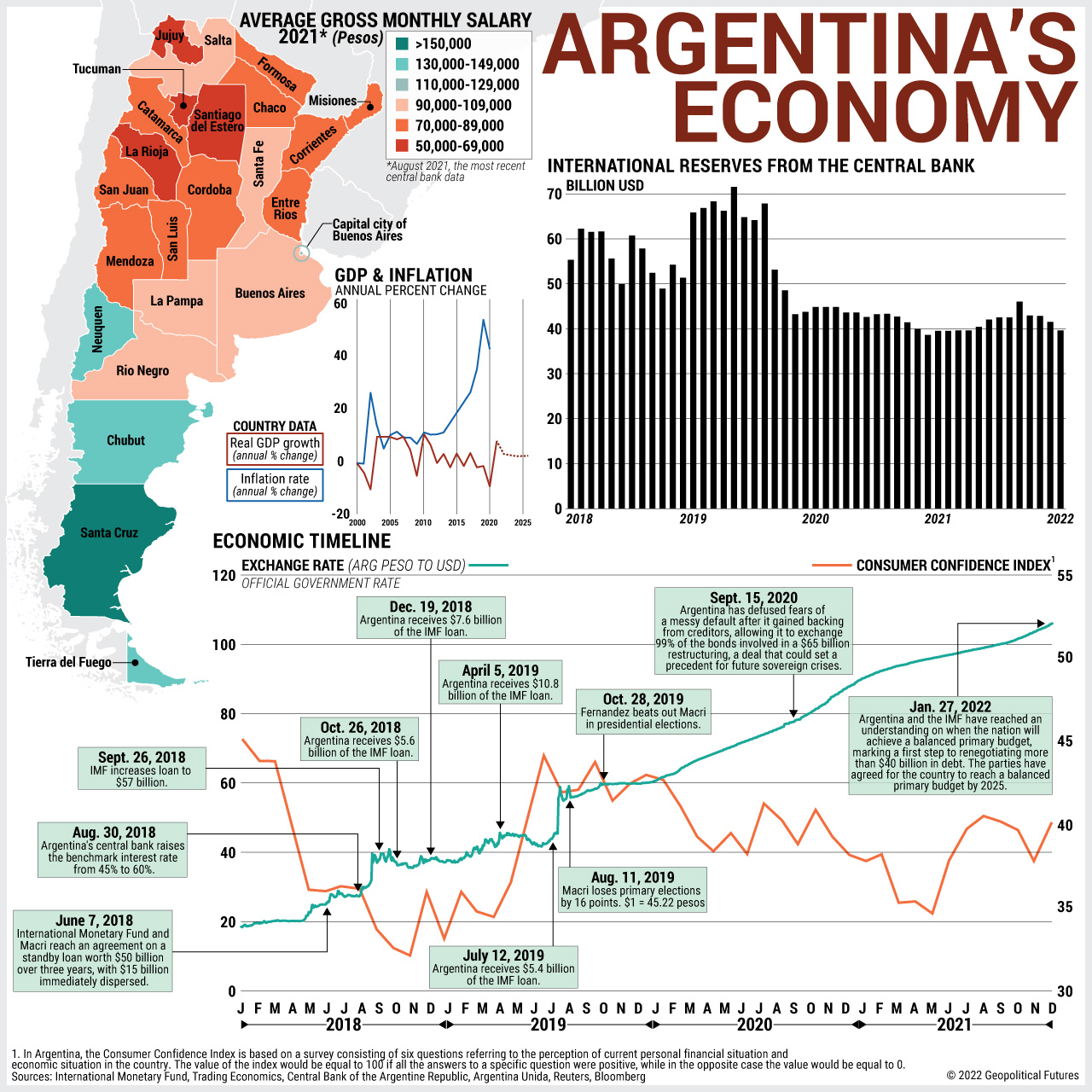

The Central Bank of Argentina announced the implementation of a managed float regime, allowing the peso to trade within a band of 1,000 to 1,400 pesos per U.S. dollar. This band will adjust by 1% monthly, replacing the previous crawling peg system that featured a fixed monthly devaluation rate. This approach seeks to balance market flexibility with controlled currency fluctuations, aiming to prevent abrupt devaluations while enhancing competitiveness.

Details of the IMF Agreement

The IMF‘s Executive Board approved a 48-month Extended Fund Facility (EFF) arrangement totaling $20 billion, with an immediate disbursement of $12 billion and an additional $2 billion expected by June. The program focuses on sustaining a strong fiscal anchor, transitioning to a more robust monetary and foreign exchange regime, and advancing structural reforms to foster productivity and growth.

Easing of Currency Controls

In conjunction with the IMF deal, Argentina has lifted significant currency controls, including the fixed peso-dollar peg and restrictions on foreign currency access. The new policy allows the peso to fluctuate within the established band, aiming to reduce inflation and enable tax cuts. Economy Minister Luis Caputo emphasized that these measures are designed to restore economic normalcy and attract investment.

International Support and Economic Outlook

Beyond the IMF, Argentina is set to receive $12 billion from the World Bank and $10 billion from the Inter-American Development Bank to bolster its foreign currency reserves. These funds are expected to support the country’s efforts to stabilize its economy and re-access international capital markets.

Expert Opinions and Market Reactions

Economists have largely welcomed the reforms, viewing them as vital steps toward economic stabilization. The Argentine Banks Association highlighted the necessity of improving the central bank’s balance sheet, while the American Chamber of Commerce in Argentina praised the agreement for promoting macroeconomic stability. However, experts caution that lifting controls amid global market volatility may trigger short-term instability and devaluation of the peso.

Historical Context and Future Challenges

Argentina’s relationship with the IMF has been complex, with the country entering into 23 programs totaling $177 billion since 1958. Past IMF-backed measures have often failed to stabilize the economy, leading to public skepticism. President Milei’s administration aims to break this cycle through stringent fiscal policies and market-oriented reforms. While initial signs are promising, including achieving a fiscal surplus, the government faces challenges in managing economic adjustments and maintaining public support.

Conclusion

Argentina’s adoption of a managed float for the peso and the securing of a substantial IMF deal mark a pivotal moment in the nation’s economic trajectory. These measures reflect a commitment to structural reform and fiscal discipline. However, the success of these initiatives will depend on effective implementation and the government’s ability to navigate potential economic and social challenges.

Written by Sigmanomics Economics Team