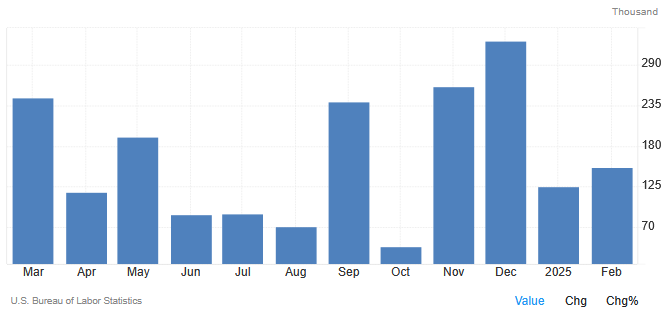

In February 2025, the U.S. labor market demonstrated resilience by adding 151,000 jobs, a slight increase from January’s revised figure of 143,000. However, this growth fell short of economists’ expectations of 160,000 new positions. The unemployment rate experienced a modest uptick, rising to 4.1% from the previous 4.0%.

Sector-Specific Employment Trends

Healthcare and Social Assistance: This sector led job creation, contributing significantly to the overall employment gains.

Retail and Leisure: Conversely, these industries faced challenges, with both sectors reporting job losses in February.

Manufacturing: The manufacturing sector experienced a reduction of 13,000 jobs in December 2024, following an increase of 25,000 in November.

Impact of Government Policies and Layoffs

The labor market’s performance in February largely predates significant disruptions from recent government actions. Notably, the Department of Government Efficiency (DOGE), under the direction of Tesla CEO Elon Musk, announced substantial federal layoffs. In February alone, the federal government announced 62,242 job cuts across 17 agencies, contributing to a total of 172,017 layoffs—the highest monthly total since July 2020.

Additionally, President Donald Trump’s tariff policies have introduced further economic uncertainty. The administration’s shifting stance on tariffs, including temporary reprieves for Mexico and Canada, has led to volatility in the U.S. dollar and raised concerns about future economic growth.

Economic Indicators and Market Reactions

The average workweek for all employees on private nonfarm payrolls remained steady at 34.3 hours in December 2024. Average hourly earnings increased by 0.3% over the month, reaching $35.69, with a year-over-year rise of 3.9%.

In response to the employment data and prevailing economic uncertainties, the S&P 500 futures dipped by 0.2%, and the 10-year Treasury yield fell to 4.22%. These movements reflect investor caution amid potential economic headwinds. Investors.com

Looking Ahead

The Federal Reserve is closely monitoring these developments as it prepares for its mid-March meeting. Market participants are anticipating potential interest rate adjustments in response to the evolving economic landscape. The combined effects of federal layoffs and tariff policies are expected to influence future employment reports, potentially leading to increased volatility in the labor market.

Conclusion

While the U.S. labor market exhibited moderate growth in February 2025, the impending impact of federal layoffs and tariff policies introduces significant uncertainty. Stakeholders should remain vigilant, as these factors are poised to shape the trajectory of employment and economic stability in the coming months.

Written by, Sigmanomics Team