2026 Economic and Market Outlook: Bullish Outlook, But Geopolitical Uncertainty Remains

Summary: As an aggregate, key economic indicators point towards the global economy growing further in out 2026 Economic and Market outlook. In particular, the G20 countries, which account for roughly 80% of the total global GDP are projected to grow by 2.9% next year. India is set to lead the pact, with growth forecast at 6.2% next year, ahead of both China (4.4%) and the US, which is forecasted to grow by only 1.7%, below the G20 average. In addition, headline inflation among G20 countries is expected to slow down further next year from 3.4% to 2.8% cumulatively.

2026 Economic Indicators

A. GDP Growth

GDP growth projects

Source: OECD Economic Outlook (December 2025)

https://www.oecd.org/en/publications/2025/12/oecd-economic-outlook-volume-2025-issue-2_413f7d0a

The GDP growth among G20 countries (major economies that collectively account for about 80-85% of the entire global GDP) is expected to taper from 3.2% in 2025 to 2.9% in 2026. According to OECD, this slowdown is attributed to the imposed higher effective tariff rates, which are led by the US. In addition, OECD also weighed in on the likely continuation of global geopolitical and policy turmoil.

Inflation Projections for 2026, 2027

B. Inflation

Source: OECD Economic Outlook (December 2025)

https://www.oecd.org/en/publications/2025/12/oecd-economic-outlook-volume-2025-issue-2_413f7d0a

Despite the added economic pressure from tariffs, headline inflation among the G20 countries is expected to further soften from 3.4% in 2025 to 2.8% in 2026. However, one notable outlier is the US, where inflation is expected to increase slightly faster, from 2.7% in 2025 to 3.0% in 2026. This is mainly due to higher input and import costs brought by the universal tariffs imposed by the US.

C. US Interest Rates Source: US Federal Reserve (Fed) via Trading Economics

Source: US Federal Reserve (Fed) via Trading Economics

https://tradingeconomics.com/united-states/interest-rate

The US Federal Reserve (Fed) recently made an additional rate cut of 25-bps in December, bringing its policy rate to 3.5%-3.75%, the lowest since 2022. The recent cut followed earlier reductions that began in the second half of 2025, lowering the interest rate from 4.5%, which had held steady from January to August.

This series of rate cuts, while expected to contribute to higher inflation next year, will likely lead to higher asset prices, as interest rate cuts have historically boosted financial markets, as it directly brings down borrowing costs and supports an expansionary economic environment, both of which are bullish signals for companies and investors alike.

D. 2026 Major Economic Risk

In 2026, the main economic risk we believe will have a significant, outsized, and far-reaching impact on the global economy is a potential resurgence of trade barriers, led by either (or both) of the two largest economies, the US and China. In 2025, we witnessed how the exchange of higher tariffs between the two has not only significantly impacted these two major actors but also the entire global economy (this is on top of the universal tariffs that the US imposes on almost all countries).

Furthermore, we saw how input costs and general prices have increased as either a direct or indirect result of these tariffs (including the retaliatory measures made by China and other countries, which exacerbated the negative impact on the global economy). In fact, the general consensus is that the overall global economy, including the US and China, could have grown further if these trade barriers had not been imposed.

Note: Stay tuned to our regular and up-to-date economic analyses via https://sigmanomics.com/economics where we cover and break down key economic events that move markets. To check the upcoming major economic announcements, you can browse our economic calendar at https://sigmanomics.com/economic-calendar.

Market Analysis

2025 Review and 2026 Forecast

Summary: US financial markets have performed exceptionally well in 2025, shattering early expectations of a longer-lasting pullback and consolidation following a major bearish move from late February to April. In fact, all three major indices (S&P 500, NASDAQ 100, and Dow Jones) reached historic highs in the second half of the year and continued into December 2025. As the year closes, all three major indices are poised to post well-above-average yearly double-digit growth.

S&P 500 (SPX)

2025 Overview:

The S&P 500 Index (SPX) is currently up by more than 17% Year-to-Date. This is remarkable, given that it experienced a sharp double-digit decline from late February through April (as shown in the image). Since April, it has rebounded and proceeded to move in a strong upward fashion, creating new all-time highs in the second half of the year. Hence, it’s heading into 2026 with a strong bullish momentum.

2026 Market Outlook:

Best-Case Scenario: SPX breaks above 8,000 and moves into the 8,000 and 8,500 levels before the year ends.

Base Scenario: SPX stabilizes and moves between 7,000 and 7,900 throughout the year.

Worst-Case Scenario: SPX fails to break 7,000 and moves under this price level for the rest of the year.

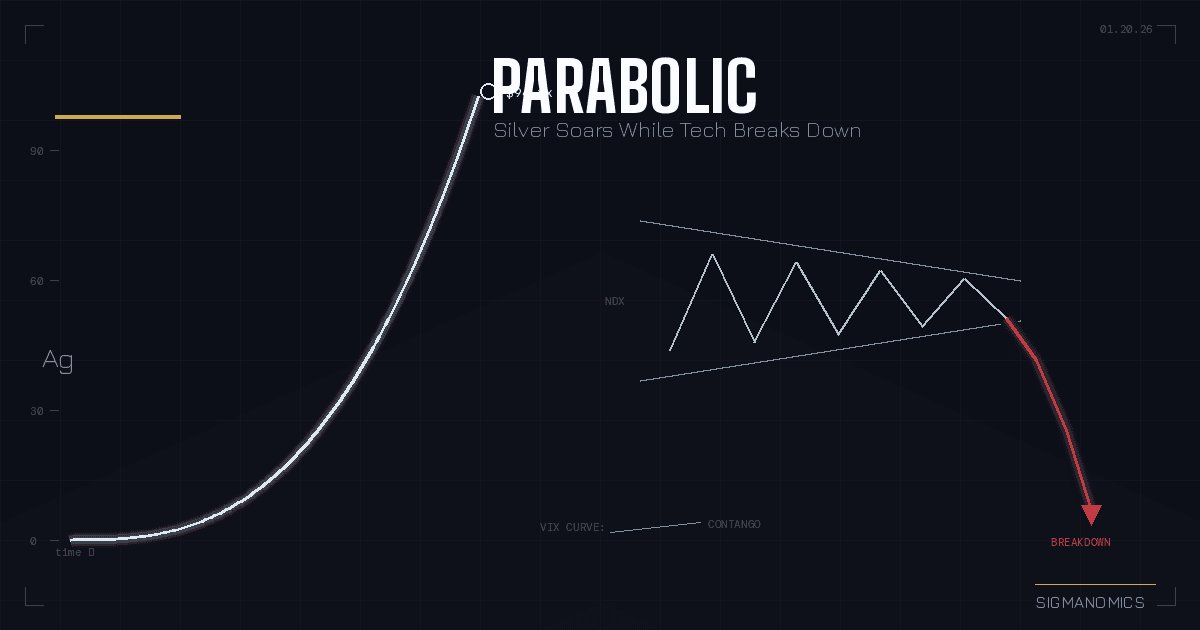

NASDAQ 100 Index (NDX) Source: Sigmanomics.com

Source: Sigmanomics.com

2025 Overview:

The NASDAQ 100 Index (NDX) outpaced SPX (+17%) and DJI (+14%) with the highest Year-to-Date gain of roughly 21%. The tech-driven index followed SPX’s trend this year, just with more volatility, propelling it to post significant outperformance. Similar to SPX, it carries its established intra-year uptrend through January 2026 as it is poised to break 50,000, a landmark price level.

2026 Market Outlook:

Best-Case Scenario: NDX breaks the 50,000 price level and sustains this bullish momentum to reach 60,000 before the year ends.

Base Scenario: NDX breaks the landmark 50,000 major price level and turns it into a major support level throughout the year.

Worst-Case Scenario: NDX fails to break 50,000 and proceeds to move between 49,000 and 45,000 throughout the year.

Dow Jones Industrial Average Index (DJI) Source: Sigmanomics.com

Source: Sigmanomics.com

2025 Overview:

The Dow Jones Industrial Average (DJI) has moved in a similar fashion to SPX and NDX, albeit in a more conservative, toned-down manner. Compared with the other two main indices, it posted a roughly 14% Year-to-Date gain, still above average, yet the lowest among the three indices. Nonetheless, together with the other two indices, it is poised to sustain its upward momentum through 2026 as the recent interest rate cut fuels bullish sentiment in the market.

2026 Market Outlook:

Best-Case Scenario: DJI breaks the 30,000 major resistance level within the year.

Base Scenario: DJI moves between 25,000 and 29,000 throughout the year.

Worst-Case Scenario: DJI falls below 25,000 and proceeds to move between 21,000 and 24,000.

To help you better understand financial markets and break down seemingly complex financial jargon, you can explore our free educational resources at https://sigmanomics.com/education. You can also check our latest financial analyses at https://sigmanomics.com/financial where our experts cover crucial financial news and updates.

Overall, 2026 is looking like another strong year for US markets. On the fundamental side, the recent and continuous rate cuts toward the end of 2025 fuel bullish sentiment as they support an expansionary economic environment. In addition, on the technical side, the strong uptrend in 2025 (with new all-time highs) will likely continue towards 2026.

Dave Calutan, MBA

With 10 years of extensive investing and trading experience across Global Financial Markets, including US and International Stocks, Indices, ETFs, Forex, Cryptocurrency, Derivatives (Options & Futures), and Commodities (e.g., Gold & Oil). As a testament to Dave's investment expertise, he has won the National Stock Trading Competition '18.