Ethereum ETFs Outshine Bitcoin in August — Is the Flippening Finally Here?

August 2025 was an incredible month for the cryptocurrency space. Bitcoin (BTC), the largest digital asset in the world by value, touched a new peak. And with it, carried the entire crypto market past the $4 trillion mark for the first time. But towards the month’s end, headlines turned to Ethereum (ETH) as inflows into its ETFs outperformed BTC ETFs. And investors are now wondering if this could be the start of a paradigm shift, or it’s just a short-term trend.

Ethereum ETFs and Price Action Break Records

In August, lots of investors put money into Ethereum; $4 billion to be precise, according to VanEck data. At the same time, $600 million was pulled out of Bitcoin. The money flow was through exchange-traded products (ETPs), also called exchange-traded funds (ETFs).

Typically, ETPs are popular among institutional investors. That means more institutions bought ETH in August than BTC. VanEck stated that ETH ETPs now hold about 3% of the network supply. But despite the surge, the total net flow across all crypto ETFs as of early September was -$390.2 million, CoinMarketCap data shows. Nonetheless, Ethereum’s performance eroded Bitcoin’s dominance in the crypto market, reducing it from 65% to 58% as of September 5.

Figure 1: ETH ETP flows vs BTC ETP flows, Source: VanEck

Ethereum also overtook Bitcoin in monthly spot trading volume on centralized exchanges for the first time in seven years. The ETH spot trading volume for August 2025 reached $480 million, compared to BTC’s $401 million. This historic flip in trading dominance was further reinforced by returns; BTC declined by 5.55% in August while Ethereum gained 18.30%.

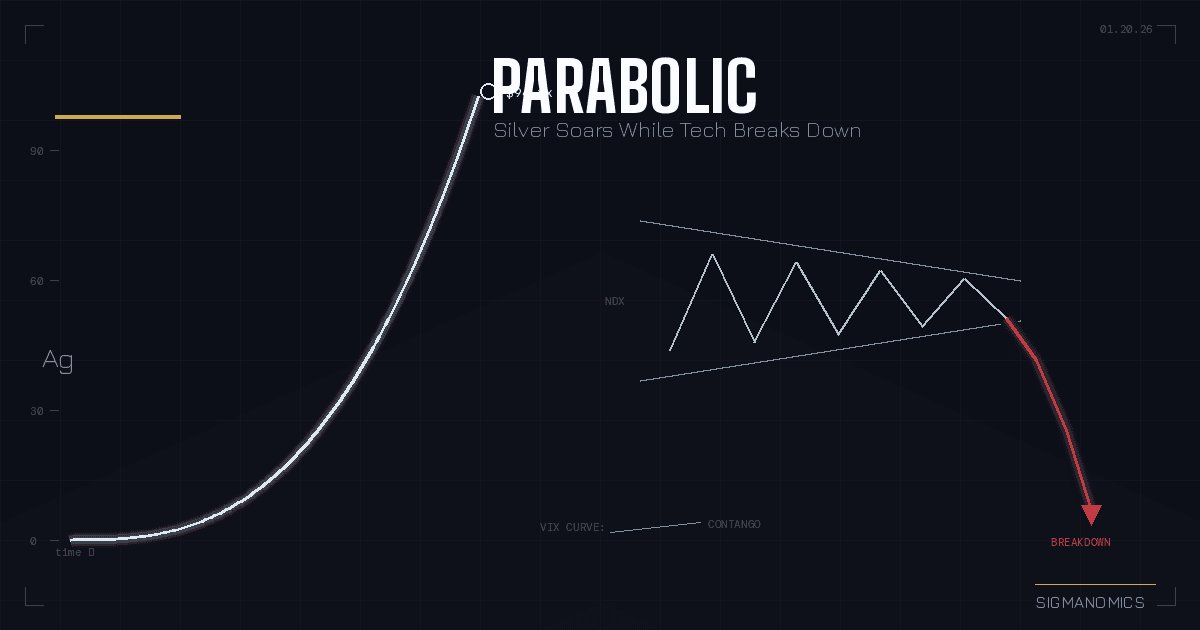

Figure 2: ETH/USD vs BTC/USD over the past one month, Image Source: Sigmanomics.com

What Drove Ethereum’s Surge?

Ethereum’s price surge in August is not a speculative anomaly but rather a response to several catalysts. This began with the SEC’s approval of ETH ETFs in May last year. According to Coincover’s Alex Saleh, the policy change was a regulatory endorsement that set Ethereum on the path to acceptance by a lot more institutional buyers.

Fast forward to late July 2025, and the SEC allowed in-kind redemptions for both Bitcoin and Ethereum spot ETFs. As a result, ETF issuers can exchange actual ETH tokens for ETF shares, rather than relying solely on cash settlements. This opened doors for more institutional investors to snap up ETH ETFs.

So, institutions piled into the digital asset. A CEX.IO analysis shows that as of July 31, 2025, public companies held over $124 billion in crypto assets. This was a 115% year-to-date growth, and Ethereum accounted for $6.2 billion of that (an increase of over 5,000% since January). BitMine Immersion had accumulated 1.52 million ETH (~$5.1 billion) as of August 25, according to CCN data. SharpLink Gaming owned 740,760 ETH ($3.3 billion), and Coinbase Global had 136,782 ETH ($601.22 million). A large number of the coins were acquired between July and August 2025. CCN added that combined small-cap firms added 966,304 ETH, up from just 116,000 ETH in late 2024.

In fact, a Standard Chartered report stated that corporations had acquired over 1% of the total ETH supply between June and July 2025. It noted that decentralized finance (DeFi) access and staking rewards were the major drivers. For Zack Shapiro, an attorney at the Bitcoin Policy Institute, “Those vehicles [referring to institutional buyers] are out there buying Ethereum. And so that could also be additional buy-pressure that’s moving up the price.”

The Flippening Debate

If you zoom out for a moment, you will notice that altcoins (any cryptocurrencies other than Bitcoin) have been gaining popularity in the past few months. Institutional adoption has been a massive tailwind in this growth. CEX.IO’s analysis found that altcoin treasuries grew over 6,700% between January and July 31, 2025. And the main driver of the altcoin adoption is Ethereum.

Figure 3: Altcoin corporate treasuries distribution, by total value held (as of July 31, 2025). Source: Sigmanomics.com

To some, this could be a signal that the crypto market is entering a new era, where Ethereum leads altcoins in claiming dominance. There is even a name for this event: “flippening.”

Flippening is a fun term that crypto enthusiasts use to describe a possible future moment when Ethereum becomes more valuable than Bitcoin. At writing (September 5), Bitcoin’s market capitalization accounted for 58% of the total value of the crypto market; Ethereum’s was roughly 14%.

The idea of Ethereum reversing positions with Bitcoin started getting popular around 2017. This was the time when ETH was growing fast, so much so that some thought it might soon claim market dominance. At the time, ETH rose to $36.8 billion in 2017, just 17% shy of overtaking Bitcoin. Fueling this surge was the initial coin offering (ICO) boom – Ethereum was the springboard on which ICO projects launched their tokens. But the run was short-lived; both BTC and ETH crashed by about 60% shortly after.

Flippening reignited during the 2021 bull cycle. Just like in 2017 when Ethereum powered ICOs, this time it was the basis for non-fungible token (NFT) and DeFi projects. The resulting network activity and transaction volume lifted the ETH/BTC ratio to a peak of around 0.08.

Figure 4: Flippening almost happened in 2017, then never again. Source: Blockworks

The August performance seems to support those, like Joe Lubin, Ethereum co-founder, who believe that ‘flippening’ is a matter of ‘when’, not ‘if’. In late July, Lubin told CNBC’s ‘Fast Money’ that Ethereum’s utility across DeFi, NFTs, and smart contracts gives it broader economic relevance. He added that corporate treasuries like SharpLink Gaming are validating ETH as a strategic asset. “I think we’ll see some astonishing things in the next year or so,” he stated.

Jean-Marc Bonnefous, managing partner, Tellurian Capital, believes that the August surge was due to “The spread ETH-BTC is now being aggressively bought since its lows in April 2025.” “I believe it has some more room to go,” he added. His argument? The ETH/BTC ratio is recovering on the back of institutional rotation and hedge fund positioning.

On August 23, Tom Lee, Fundstrat Co-Founder and BitMine Chairman, said on the ‘Altcoin Daily’ podcast that there is a “high probability”, potentially 50%, of the Flippening occurring soon. Lee argued that ETH is positioned as the “biggest macro trade for the next decade.” He predicts that ETH could reach $330,000 in the long term, far outpacing BTC.

But the market’s response has been swift. Farside Investors’ data show that Bitcoin ETFs took in $633.3 million in inflows from September 3 to 4 – the strongest performance since early August. Analysts see this movement as concentrated dip-buying, as well as rotation from ETH ETFs. CEX.IO’s Illia Otychenko stated that investors are “reallocating funds back into BTC from ETH, as uncertainty lingers over what may follow a potential rate cut this month.”

According to Maria Carola, CEO of StealthEx, many institutions and investors view BTC as the safest digital asset for the long term. As such, the latest inflows back into the Bitcoin ETFs (and outflows from ETH) are a long-term hedge play, particularly in anticipation of the Fed debasing the US dollar this September.

In other words, Bitcoin’s store-of-value and stability narrative appears to triumph over Ethereum’s utility and growth narrative. Which is just another way of saying: “If there’s a status quo in the digital assets space, it’s Bitcoin.” And ‘flippening’ may never happen.

Neha Gupta

Neha Gupta is a Chartered Financial Analyst with over 18 years of experience in finance and more than 11 years as a financial writer. She’s authored for clients worldwide, including platforms like MarketWatch, TipRanks, InsiderMonkey, and Seeking Alpha. Her work is known for its technical rigor, clear communication, and compliance-awareness—evident in her success enhancing market updates.