Fed’s First Cut of 2025 Sends Shockwaves Through Global FX: Winners, Losers, and What’s Next

The US dollar (USD) is teetering near its weakest level since 2022, with performance in the first half of 2025 marking the worst stretch since the 1970s. The Fed’s first rate cut of the year has certainly weakened the greenback, but politics may be just as corrosive; President Trump’s words and actions are fueling doubts about the dollar’s dominance. The question now is whether this ‘king of currencies’ is merely wobbling, or whether we are witnessing the start of a sustained down-cycle in USD power.

The Fed’s Dovish Pivot

The Board of Governors of the Federal Reserve System (the Fed) issued a press release on Wednesday, September 17, in which it communicated news that the market has been eagerly waiting for. It stated that the Federal Open Market Committee (FOMC) – the body in charge of rate decisions – had decided to cut the target federal funds rate by 0.25%. So now, the interest rate falls below 4.3% for the first time since December 2022.

Before this decision, the FOMC had met five times this year. And at the end of all those meetings, the 4.25%–4.50% target range stood unchanged. Each time, Chairman Jerome Powell stated that the economy wasn’t ready for a looser monetary policy. In January, for example, Powell argued that there were balanced risks to employment and inflation, signaling no immediate need for a cut.

The Fed’s decision has not been without political intrigue. Trump started calling Powell an “enemy” since early 2025 for keeping rates too high despite signs of economic slowdown. He repeatedly posted on Truth Social that Powell was “too late” and demanded aggressive rate cuts, not just the standard 25-basis-point (bps) moves. Early this month, Trump nominated Stephen Miran, his economic adviser, to the Fed’s Board of Governors. Miran was confirmed just hours before the September FOMC meeting. There was also an attempt to fire Fed Governor Lisa Cook, a move a federal judge blocked.

Powell described the rate decision as “risk management”, not a full pivot, but acknowledged the labor market was softening. But for Dan North, Chief Economist, Allianz Trade North America, Powell’s words couldn’t be further from the truth. “I don’t think that’s risk management. I think that’s steering the ship,” he told CNBC. He added: “I think it’s a move where we’re definitely trying to manage the economy and not just say, ‘OK, we’re going to take this little cut here and use it to help prevent anything from getting worse.’”

Market Reaction

Expectedly, there was a “sell the news” reaction in the forex market. The US Dollar Index (DXY) initially plunged before partially recovering. The DXY, which measures the greenback’s value against a basket of peers, opened the day at around 96.67. It hovered near its 2025 lows amid pre-meeting pricing of a roughly 90% chance of the cut and expectations for two more reductions by year-end.

Post-announcement, the index slipped nearly 0.7% within minutes, hitting an intraday low of 96.30; the lowest level since June. The only other time the index dropped so drastically this year was on July 16, when President Trump hinted at dismissing Fed Chair Powell. But by late session, the DXY had recovered most losses, closing at 97.02. This “round-trip” move mirrored Treasury yields, which briefly fell below 4% on the 10-year before climbing back.

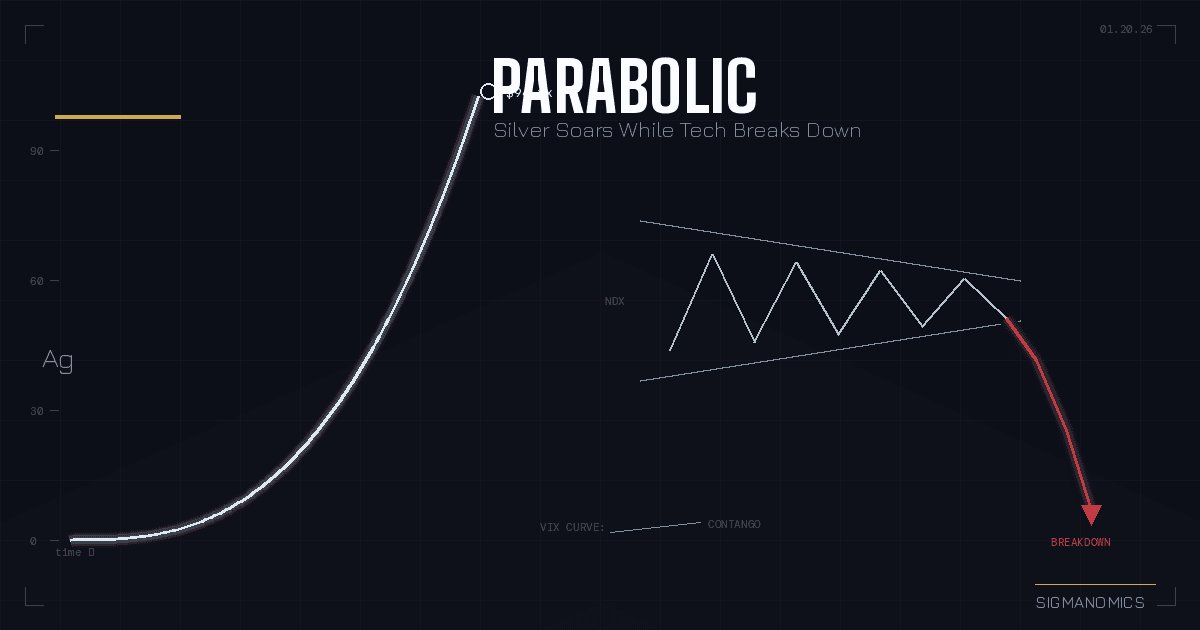

Source: Sigmanomics

Source: Sigmanomics

Barron’s Karishma Vanjani finds the plunge striking. And although it is not the largest single-day drop in recent memory, Vanjani’s analysis concluded that it exacerbated the DXY’s year-to-date malaise. The index is down around 10.8% through mid-September 2025, the worst first-half performance in over 50 years. This broader weakness, stated Vanjani, stems from tariff-induced growth fears, softening jobs data, and ongoing Trump-era pressures on Fed autonomy.

But at writing, the DXY had clawed back to around 97.66. And Eric Theoret, FX strategist at Scotiabank, has an idea why the dollar recovered so quickly. For starters, Powell’s words fell short of the “unequivocal dovishness that the markets were expecting,” Theoret stated. Second, the greenback rebounded so fast thanks to Thursday’s strong economic data and the earlier wave of heavy selling earlier in the week.

Is This a Secular Down-Cycle for the Dollar, or a Temporary Wobble?

The greenback’s underperformance against its peers in the first half of 2025 is unusually large. We saw earlier that the last time such a decline was recorded was in the 1970s. Such a move can reset long-term positioning, especially when accompanied by fundamental changes in investor behavior.

Speaking of behavioral change, a recent Deutsche Bank analysis found that overseas investors continue to buy US stocks and bonds but are layering on currency protection. The Bank termed this move the “Hedge America” trade – a strategy where foreign investors purchase US assets but use derivatives to remove currency risks. According to the Bank, investors are cutting dollar exposure at a record pace. And when global allocators move from being naturally long-USD to actively hedging or shorting it, that’s a structural change in cross-border demand for dollars.

According to the Financial Times, this behavior helps explain why US equities have roared back after the April sell-off, but the momentum hasn’t triggered a similar recovery in the greenback. For context, the S&P 500 has surged over 33% since the “liberation day” tariff announcement in April. The DXY, on the contrary, is down 5%. In other words, the USD has kept sliding for the better part of 2025, while the stock market beats a record high after another. Source: Google Finance

Source: Google Finance

To Arun Sai, senior multi-asset strategist at Pictet Asset Management, the US dollar is in a secular bear market. And this posture will sustain if actions from Washington keep eroding the greenback’s safe-haven premium. Sai stated: “It will continue to be the dollar that takes the brunt of eroding institutional credibility.”

But the dollar’s woes may be nothing serious; the market could be worrying itself dead over a cyclical adjustment. Some might argue that the slump is a classic mean-reversion play, given that the USD surged in late 2024. The nose-dive could have been exacerbated by crowded bearish bets and Fed easing that’s now largely priced in.

Mary Park Durham, a Research Analyst at JPMorgan Asset Management, noted that the dollar might still have some distance to go in terms of weakness. She, however, emphasized that the USD’s reserve currency status remains intact. The greenback still accounts for 58% of foreign currency reserves; that’s far ahead of any competitor, and there’s no viable alternative in terms of trust, liquidity, and global usage, she added.

There is also the case that periods of dollar weakness tend to coincide with strong stock market returns. A Forbes analysis notes that historically, a median 18% drop in the dollar over roughly 14 months has led to a 21% gain in the S&P 500. The suggestion here is that dollar downtrends are often part of broader cyclical reflation phases rather than a sign of structural decline.

The Renminbi Is a Clear Winner

Be that as it may, the dollar weakness is happening when the Chinese renminbi is resurgent. The Chinese currency had weakened sharply against the greenback during Biden’s administration, but has now rallied 2.3% this year as of early September 2025. Most importantly, the renminbi has strengthened against the dollar since “liberation day.”

Neha Gupta

Neha Gupta is a Chartered Financial Analyst with over 18 years of experience in finance and more than 11 years as a financial writer. She’s authored for clients worldwide, including platforms like MarketWatch, TipRanks, InsiderMonkey, and Seeking Alpha. Her work is known for its technical rigor, clear communication, and compliance-awareness—evident in her success enhancing market updates.