With Job Growth Faltering and Political Pressure Rising, Has the Fed Waited Too Long to Act?

The Federal Reserve is in a dilemma. Inflation is surging, but employment numbers are weak. For some time, the Fed has staved off pressure to cut interest rates, but the pressure emanating from the White House may force a shift. And the debate over whether the central bank has waited too long to act is heating up. So, has the Fed miscalculated the risks of waiting?

A Muted Labor Market and a Massive Revision

The Bureau of Labor Statistics (BLS) put out the July 2025 jobs figures on Friday, and it was a shock. According to the report, there were only 73,000 new jobs during the month, although the unemployment rate remained steady at 4.2%. The labor force participation rate sank 0.5% to 62.2% year-over-year. At the same time, the number of Americans classified as ‘long-term unemployed’ ticked up by 179,000, bringing the total to 1.8 million, around a quarter of the unemployed.

But the juiciest part of the release is that the BLS revised downwards the May and June payrolls. Instead of the 144,000 jobs the BLS said were created in May, the revised number is 19,000, as was the 147,000 figure for June adjusted to 14,000. This is a massive downward adjustment of around 258,000 combined.

This data indicates that, excluding the period during the pandemic, the second quarter of 2025 is the weakest for job growth since 2010 (during the Great Recession). The May and June revisions are also the largest non-recessionary adjustments since 1968. Some have described the labor market as “stalling out” and “badly wounded.”

However, the White House doesn’t seem to have liked the conflicting messaging from the BLS. Hours after the explosive jobs data was released, President Donald Trump fired the head of the BLS. The president took to social media, claiming that the country’s jobs reports “are being produced by a Biden appointee” and directed his administration to dismiss her.

Trump wrote: “I was just informed that our Country’s ‘Jobs Numbers’ are being produced by a Biden Appointee, Dr. Erika McEntarfer, the Commissioner of Labor Statistics… She will be replaced with someone much more competent and qualified. Important numbers like this must be fair and accurate, they can’t be manipulated for political purposes.”

Political Pressure Mounts on the Fed

Something else that Trump said in that Truth Social post is instructive. He said: “The Economy is BOOMING under ‘TRUMP’ despite a Fed that also plays games, this time with Interest Rates, where they lowered them twice, and substantially, just before the Presidential Election, I assume in the hopes of getting ‘Kamala’ elected – How did that work out? Jerome ‘Too Late’ Powell should also be put ‘out to pasture.’”

In late January of this year, President Trump appeared to initiate public pressure on the Fed, requesting immediate rate cuts. Speaking at the World Economic Forum in Davos, he said he would “demand that interest rates drop immediately,” citing falling oil prices and claiming he understands monetary policy better than Fed officials. At a subsequent White House event, he reiterated that he knows interest rates “much better” than Federal Reserve Chair Jerome Powell, whom he appointed during his first term.

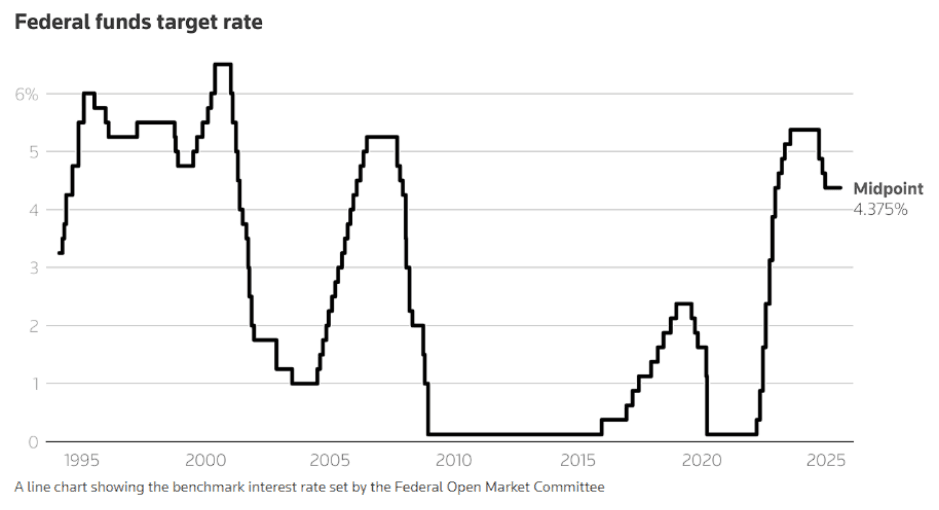

But the pressure didn’t change the Fed’s mind; the federal funds rate stayed the same during the January 29 Federal Open Market Committee (FOMC) meeting. Powell insisted that “the public should be confident that we will continue to do our work as we always have.”

Trump was once again on Powell’s neck after the March FOMC meeting held rates steady. Again, the Fed responded that the economy was solid (low unemployment, steady hiring), so they’d wait before any decision to cut the rates would be made.

At the July FOMC meeting, the Fed stuck to the 4.25% to 4.50% target range. However, two governors, Christopher Waller and Michelle Bowman, dissented. The dissenting voices advocated for a quarter-point cut, although Trump is pushing for a 1% cut. It is worth noting that no FOMC meeting has had dissenters for more than 30 years. NBC News described this as “a sign of both the economic uncertainty and the political pressure on the central bank.”

Source: Reuters

Source: Reuters

A “Nightmare Scenario” for the Fed

Unfortunately for the Fed, the scenario doesn’t appear as they thought in light of the latest BLS jobs data. One analysis shows that excluding jobs in healthcare, job growth in July is flat, and it was negative in both June and May.

Diane Swonk, Chief Economist at KPMG, said the BLS report screams “weak” with respect to the labor market. And the situation may worsen. According to a Principal Asset Management analyst note, the massive downward revisions to June and May are calamitous to the picture of labor market robustness. But, what is more concerning is that “with the negative impact of tariffs only just starting to be felt, the coming months are likely to see even clearer evidence of a labor market slowdown.”

To Ernie Tedeschi, Director of Economics at Yale Budget Lab, the weak jobs report and revisions were a “nightmare scenario for the Fed.” He believes that the US is smack in the middle of a stagflationary environment where the labor market is weakening while inflation remains high. The data suggests the Fed may be “behind the curve,” as prolonged uncertainty and a shrinking labor force could exacerbate inflationary pressures, complicating the decision to cut rates or maintain them to curb inflation.

In other words, the Fed’s ‘wait-for-inflation-only’ stance is no longer tenable because it has misjudged the labor market’s trajectory.

Even the market has turned against the Fed now. Before the July jobs data, more than a third of interest rate traders (35.4%) surveyed by the CME believed the Fed would hold the 4.25% – 4.50% target rates at the September FOMC meeting. That share has now dropped to 7.6%.

However, the Fed’s wait-and-see posture is legitimate, even in light of the dour labor market, according to experts. Preston Caldwell, chief U.S. economist at Morningstar, argued that “the Fed has no reason to loosen monetary policy in response to a decline in job growth driven by labor supply—as such a decline is neither deflationary nor does it create a gap with respect to maximum sustainable employment.”

For Daniel Hornung, a senior fellow at MIT and a former deputy director of the National Economic Council, the Fed is in a precarious position, thanks to Trump’s “stagflationary tariff policies.”

Neha Gupta

Neha Gupta is a Chartered Financial Analyst with over 18 years of experience in finance and more than 11 years as a financial writer. She’s authored for clients worldwide, including platforms like MarketWatch, TipRanks, InsiderMonkey, and Seeking Alpha. Her work is known for its technical rigor, clear communication, and compliance-awareness—evident in her success enhancing market updates.

Source: NBC News

Source: NBC News