Americans are spending more, a fact that comes as a surprise to economists and markets alike. The broad expectation was that, with President Donald Trump’s tariffs starting to bite, retail sales would slide in June. But the rebound reshapes these expectations, as well as the expectations for the Federal Reserve’s next move. The puzzle for the Fed is now whether the economy is too strong to justify easing, or whether this rebound is just a temporary boost.

On Thursday, July 17, the US Census Bureau announced that headline retail sales rose 0.6% month-over-month. The market expected firm data; a FactSet poll of economists projected a 0.2% gain, as did a Trading Economics forecast. A Reuters poll of economists had forecast a 0.1% month-over-month increase. Clearly, the June data surprised many.

June’s data show the highest uptick in retail sales in 2025 after the 1.5% gain in March. In the other months, retail sales were on the weaker side, with decreases of 0.9% in May, 0.1% in April, and no change in January.

This rebound may be a surprise, but it does more than that. Obviously, it resets the trajectory of retail sales after two consecutive weak months. The 0.6% headline jump suggests that consumer activity hasn’t stalled, even amid inflation pressure.

Heather Long, Navy Federal Credit Union’s Chief Economist, concurs with this sentiment. She wrote in a commentary issued right after the retail sales data came out, saying, “Don’t count the American consumer out yet. There’s still a lot of trepidation about tariffs and likely price hikes, but consumers are willing to buy if they feel they can get a good deal.”

The trajectory restores some momentum heading into the third quarter and signals that Q2 won’t be a washout in terms of spending. Still, experts like Jonathan Millar, senior US economist at Barclays, believe that “June’s numbers exaggerate the underlying pace of spending.”

The rebound buoys GDP forecasts. As of the first quarter of 2025, the consumer spending component accounted for nearly 70% of the US GDP. This component is also a key factor in the Atlanta Fed’s GDPNow model, which is a tool for real-time GDP forecasting. The GDPNow model estimates (as of July 18) that Q2 2025 GDP will grow by 2.4%. Without the retail sales rebound, the growth forecast might’ve looked more fragile, especially after Q1 contracted.

Source: Federal Reserve Bank of Atlanta

The third reason this rebound matters is that it reinforces labor market resilience. Typically, stronger retail sales support hiring and hours in consumer-facing sectors. In a 2023 paper published in the BIS Quarterly Review, Doornik, Igan, and Kharroubi demonstrated that job-rich recoveries often coincide with robust consumer spending, particularly in the retail sector.

And it just happens that jobless claims in the latest data release are unexpectedly low. In the unemployment insurance weekly claims released on Thursday, July 24, the Department of Labor noted that jobless claims dipped by 4,000 to a seasonally adjusted 217,000. This is the lowest level since April, and it falls short of expectations. A Reuters analysis indicates claims have declined for six consecutive weeks, leading to the latest release.

Most importantly, the retail sales rebound delays rate-cut pressure. The Fed’s mandate balances inflation and employment, and with demand looking firmer (even if partly price-driven), the Fed should see no urgent need to cut rates. This is a position that many commentators harbor.

ING’s James Knightley acknowledges that the retail sales data “is generally on the firmer side in terms of activity and jobs.” Therefore, “it supports the view that there is little pressing need for another interest rate cut from the Fed.” For FWDBONDS’ Christopher Rupkey, “Trump 2.0 economic policies have not brought the economy to its knees yet although whether this continues to be the case going forward remains an open question.” However, the weekly jobless claims give Fed officials no cover whatsoever if they are seriously thinking of cutting interest rates at next week’s meeting.”

But whatever policy direction the Fed adopts at the upcoming Federal Open Market Committee (FOMC) meeting in under five days, the market appears settled on the rate-pause narrative. According to the CME FedWatch tool (as of July 24), 97.4% of interest rate traders expect the Fed to reaffirm the 425-450 bps target rate.

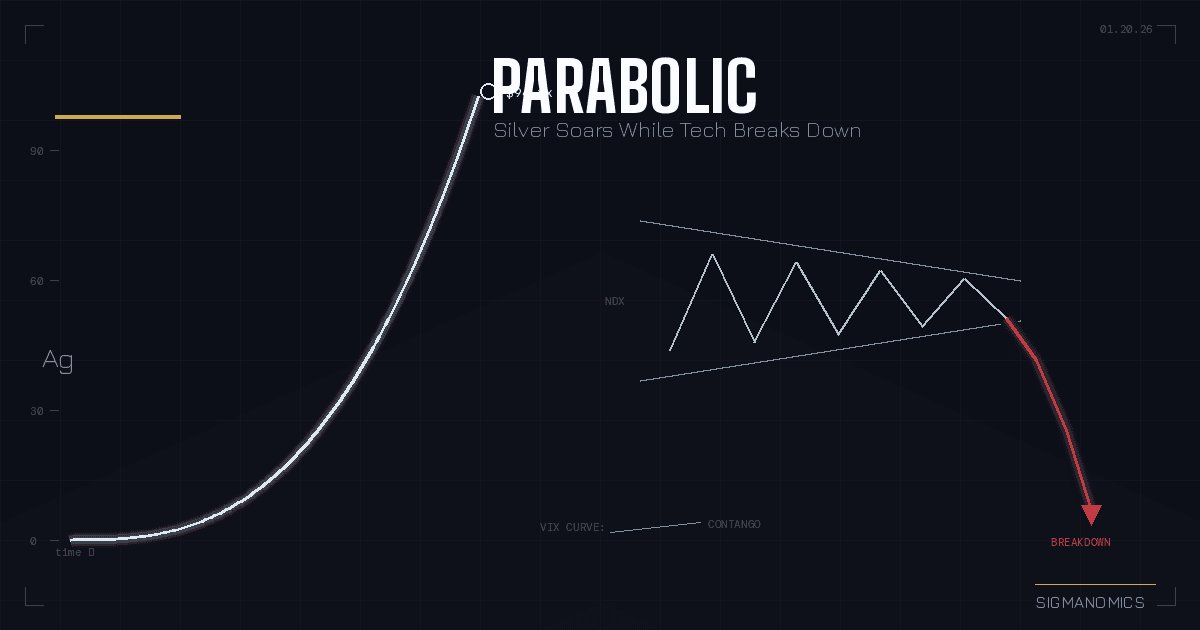

Source: Sigmanomics.com

Source: Sigmanomics.com

Source:

Source: