Sigmanomics Market Re-cap and Outlook, Week of August 04 – 08, 2025

Summary

The US equities market is in a bloodbath following President Trump’s announcement of sweeping new tariffs, which triggered renewed bearish sentiment on Wall Street. In fact, it overshadowed recently released (and relatively positive) economic data, including the US economy growing by 3% (annualized) in Q2 2025 and the Federal Reserve’s decision to keep its policy interest rate unchanged at 4.5%. The newly announced tariffs also coincide with a slight uptick in unemployment, from 4.1% in June to 4.2% in July, fueling fears that unemployment may increase further in the coming months.

On Wednesday, July 30, the U.S. Bureau of Economic Analysis released the latest GDP data, showing that the U.S. economy grew at an annualized rate of 3% in the 2nd quarter of the year. This marks a significant rebound from the 1st quarter’s negative annualized growth of -0.5% and is in line with last year’s 2nd quarter growth. That said, this growth was met with muted reaction from Wall Street, which had hoped for an improvement over last year’s 2nd quarter performance.

B. Federal Reserve Policy Interest RateSource: US Federal Reserve via Sigmanomics

On Thursday, July 31, the Federal Open Market Committee (FOMC) has, yet again, decided to keep its policy interest rate unchanged at 4.5%. This reflects the balancing act that the US central bank continues to make as it remains cautious regarding the lasting inflationary effects of Trump’s new sweeping tariffs. Many economists and analysts have been keen on pushing the Fed to take the prudent approach of raising its policy rate by at least 25 basis points to 4.75% as a hedge for potential sudden and persistent spikes in inflation due to newly introduced tariffs.

Nevertheless, the Fed is also trying to avoid triggering a potential market sell-off, as even a 25 basis point hike could be interpreted as a highly bearish signal (as it suggests the possibility of further rate increases this year and beyond). In addition, the Fed has come under pressure from President Trump, who has publicly demanded for interest rate cuts to revitalize the US economy and help sustain the bullish sentiment in the markets.

July Unemployment Rate

Source: Bureau of Labor Statistics

Source: Bureau of Labor Statistics

On Friday, August 1, the U.S. Bureau of Labor Statistics announced the official unemployment data for the month of July. As shown, there was a slight uptick in unemployment, from 4.10% in June to 4.20% in July. This translates to an additional 221,000 unemployed individuals, bringing the total to 7.24 million jobless individuals in the country. While still in line with general consensus, the uptick could be a precursor to potential further spikes as Trump pushes for higher tariffs on most countries, which could directly harm consumer demand and business sentiment.

Sweeping New Tariffs

On Friday, August 1 (the same day the unemployment data was released), Trump signed an Executive Order (EO) imposing sweeping new tariffs on dozens of countries, effectively raising average rates to 15–18%, with some countries being slapped with up to 41% (namely India, Brazil, and Switzerland). This announcement effectively triggered one of the biggest single-day drops on Wall Street since May of this year, as it rattled investor confidence and coincided with disappointing July jobs data.

Technical Analysis

Overview:

Close: 6,238.00 (-1.60%) -101.38

High: 6,287.28

Low: 6,214.43

Key Support Zone: 6,100 to 6,150

Key Resistance Zone: ~6,400 (all-time high)

In line with our previous market commentary, where we warned of a likely potential correction due to the presence of an RSI divergence. The primary indices, led by the S&P 500 did, in fact, corrected after it unsuccessfully tried to close above the 23,500 zone last Thursday (July 31), coinciding with the FOMC’s decision on keeping its policy interest rate unchanged. The following day, on Friday (August 1), the index gapped down as President Trump announced a new batch of sweeping tariffs, with many countries facing significantly higher rates.

We can observe that price has broken further below the ascending channel, hinting at a potential shift toward either a sideways movement or worse, a full-blown trend reversal to a downtrend. Hence, the tariff announcement effectively served as a major negative catalyst as it rattled Wall Street about the likely short and long-term negative economic impact that it will bring which could force the Fed to intervene by introducing policy rate hikes as early as its next scheduled FOMC meeting on September 18 to curb the expected far-reaching inflationary effects.

Best-Case Scenario: Price bounces back and breaks above 6,400, which is its previous high (and all-time high).

Base Scenario: Price consolidates around the 6,150–6,350 price range in the near term.

Worst-Case Scenario: Price breaks below its key structural support zone at 6,100–6,150.

Overview:

Close: 22,763.31 (-1.96%) 454.81High: 22,972.47

Low: 22,675.49

Key Support Zone: 22,000 to 22,200

Key Resistance Zone: 23,500 to 23,600 (all-time high),

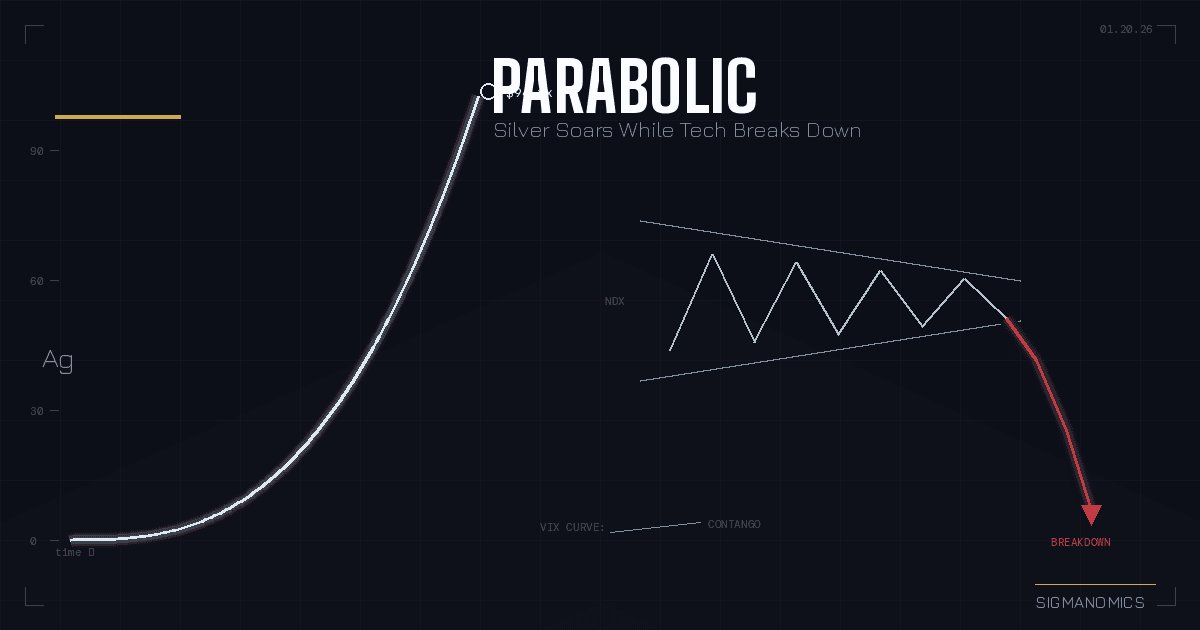

Similar to the S&P 500, the Nasdaq 100, which is composed mainly of the largest technology companies in the US, essentially mirrored the movement of the broader index and also experienced a significant correction, losing roughly 2.5% in the past two days alone as well as decisively breaking below its ascending channel’s lower boundary. Hence, in a similar fashion, it also points towards a likely shift to a sideways movement (or consolidation) in the near term, or worse, a major trend reversal to a downtrend.

Best-Case Scenario: Price bounces back and breaks above 23,500, which happens to be both its previous high and all-time high.

Base Scenario: Price consolidates around the 22,400–23,000 price range in the near term.

Worst-Case Scenario: Price breaks below its key structural support level at 22,000.

Dow Jones Industrial Average Index (DJI)

Overview:

Close: 43,588.58 (-1.23%) 542.40

High: 43,781.77

Low: 43,340.68

Key Support Zone: 42,700 to 43,000

Key Resistance Zone: 44,800 to 45,000

As we also anticipated in our previous market commentary, the Dow Jones, has continued to consolidate and, more recently, suffered a significant correction along with the abovementioned indices due to Trump’s tariff announcement. Nevertheless, compared to the S&P 500 and the Nasdaq 100 (both of which decisively broke below the lower boundary of their respective ascending channels), the Dow Jones continues to hover around its channel’s lower boundary.

Hence, as long as the index manages to get back inside its channel (as illustrated above) within the next few candles, then it would likely stay inside, at least in the near term, and avoid the worst-case scenario of breaking below its key structural support level at 42,700. In addition, if the key support zone at 42,700–43,000 is tested and holds firm without being breached, it could serve as a meaningful signal that the other major indices (the S&P 500 and Nasdaq 100), may also start to stabilize.

Best-Case Scenario: A bullish catalyst that propels it to break above its major resistance zone at 44,800–45,000.

Base Scenario: Price consolidates around the 43,400–44,400 price range in the near term.

Worst-Case Scenario: Price breaks below its key structural support level at 44,800.