Sigmanomics Market Recap and Forecast, Week of August 25 – 31, 2025

Following the significant drop in the equities market earlier this month (triggered by Trump’s announcement of renewed sweeping tariffs), the major indices—the S&P 500, the NASDAQ 100, and the Dow Jones Industrial Average—have gradually recovered and recouped their previous losses, particularly after Fed Chair Jerome Powell hinted at a potential policy interest rate change (a vague signal that Wall Street optimistically interpreted as a possible rate cut) during his speech at the recently concluded Jackson Hole symposium on Friday, August 22. Nevertheless, this week’s major economic announcements (i.e., jobless claims and home sales) delivered mixed but underwhelming results.

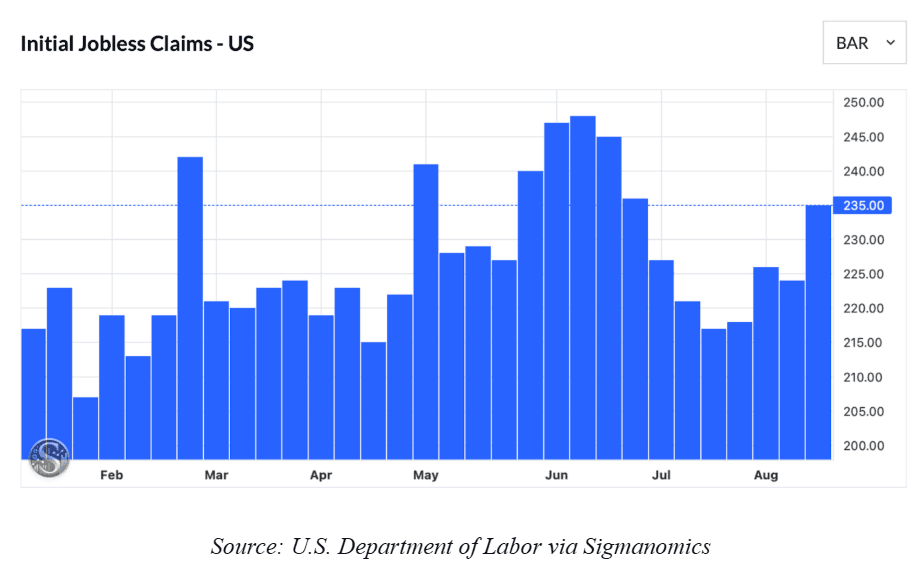

Jobless Claims

On Thursday, August 21, the initial jobless claims increased by 11,000 to 235,000. This is well above the market consensus of 225,000 and is currently the biggest one-week increase in the past 2 months. As a result, the US financial markets reacted net negatively to the news, as the data signaled that the job market is starting to weaken and overall hiring is slowing down. This negative sentiment was further fueled by fears that it could be an indirect effect of the renewed sweeping tariffs the White House announced.

Home Sales

On Thursday, August 21, the July Existing Home Sales data was released, revealing a welcome 2% improvement (from 3.93 million to 4.01 million) compared to the previous month. This uptick softens the blow of the negative sentiment brought by the increase in jobless claims that was released on the same day. Nevertheless, it is still lower than the recorded home sales earlier this year—hence it was ultimately unable to shift market sentiment to net positive.

- Fed Chair Speech

Finally, on Friday, August 22, during the Jackson Hole symposium, Fed Chair Jerome Powell hinted that the policy interest rate could soon be changed in light of recent economic reports—a signal Wall Street optimistically interpreted as a potential rate cut in September. In his speech, Powell remarked, “With policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.” This comes as a surprise, given that the Fed has held its policy rate steady at 4.5% all year despite turbulent economic and fiscal realities.

To stay on top of the key market-moving economic events, like the recently announced economic data we covered here, as well as the upcoming key economic releases/announcements in the future, you can use our free, reliable, and real-time proprietary economic calendar at https://www.sigmanomics.com/economic-calendar

Technical Analysis

Source: Sigmanomics

Source: Sigmanomics

Overview:

Close: 6,466.92 (+1.52%; +96.74)

High: 6,478.89

Low: 6,384.59

Key Support Zone: 6,200 to 6,250

Key Resistance Zone: 6,500 to 6,600

Since the start of the month of August (when it broke below its ascending channel), the S&P 500 Index (SPX) has been moving below its previous channel. As a matter of fact, the upward channel’s lower boundary has served as a key resistance level (as shown in the illustration above). Hence, for the index to move decisively bullish, it needs to break past its previous all-time high and move back into this channel in the near term.

Otherwise, if it fails to do so, then it is likely a signal of a shift in the general trend direction towards a consolidation/sideways movement in the near term. Yes, this is despite Wall Street’s initial optimism (reflected in the most recent long-bodied bullish candle) about a potential cut in the Fed’s policy interest rate in September. Note that while Powell hinted at a potential rate change, he did not decisively favor a cut. In fact, due to the mixed economic results (and fiscal uncertainties) in the recent months, the Fed may well be swayed toward a rate increase instead.

Market Outlook:

Best-Case Scenario: SPX breaks the 6,600 level (setting a new all-time high) and moves inside the previous upward channel.

Base Scenario: SPX moves between 6,300 and 6,600 in the near term.

Worst-Case Scenario: SPX breaks below its key structural support zone (6,200 to 6,250).

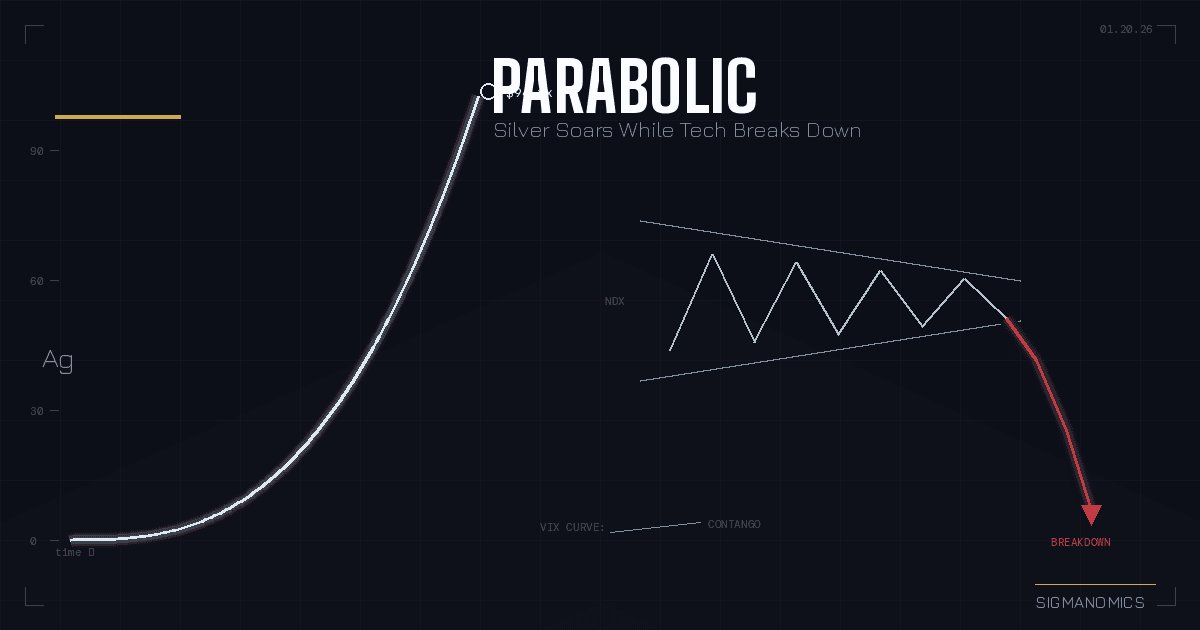

NASDAQ 100 Index (NDX)

Overview:

Close: 23,498.12 (+1.54%; +355.53)

High: 23,575.36

Low: 23,140.04

Key Support Zone: 22,500 to 23,000

Key Resistance Zone: ~24,000 (all-time high)

Similar to the S&P 500, the NASDAQ 100 Index (NDX) has been moving below its previous ascending channel (since it decisively broke below it early this month). In the next two weeks that followed, the index tried to go back inside this range, only for it to fail and move progressively lower this week (after a series of disappointing economic announcements). Similar to the S&P 500, despite the potential bullish catalyst brought by Powell’s hint of a possible rate cut next month, the index will likely consolidate in the near term unless it decisively moves back inside this channel.

Market Outlook:

Best-Case Scenario: NDX breaks past its all-time high (and into the 24,500 level) and subsequently moves inside the previous upward channel.

Base Scenario: NDX moves between 23,000 and 24,000 in the near term.

Worst-Case Scenario: NDX breaks below its key structural support zone (22,500 to 23,000).

Dow Jones Industrial Average Index (DJI)

Source: Sigmanomics.com

Source: Sigmanomics.com

Overview:

Close: 45,631.74 (+1.89%; +846.24)

High: 45,757.84

Low: 44,952.88

Key Support Zone: 44,000 to 44,300

Key Resistance Zone: ~46,000 (next key level)

In contrast with the S&P 500 and NASDAQ 100, the Dow Jones Industrial Average Index (DJI) has successfully held inside the upward channel, despite also suffering a similar significant drop early this month. Notably, when it did drop, it just hovered around the channel’s lower boundary and did not decisively break below it. Hence, when sentiments lighten up in the following two weeks, it smoothly moves back comfortably within the channel’s range. Due to this, in the near term, we expect the price to continue moving within this range unless a new catalyst emerges.

Market Outlook:

Best-Case Scenario: DJI breaks above the upper range of the current upward channel.

Base Scenario: DJI continues to move inside the upward channel.

Worst-Case Scenario: DJI breaks below its key structural support zone (44,000 to 44,300).

To learn more about these major indices, as well as how the stock market works and the basics of technical analysis, we recommend checking our free and beginner-friendly educational resources at https:/www.sigmanomics.com/education

Dave Calutan, MBA

With 10 years of extensive investing and trading experience across Global Financial Markets, including US and International Stocks, Indices, ETFs, Forex, Cryptocurrency, Derivatives (Options & Futures), and Commodities (e.g., Gold & Oil). As a testament to Dave's investment expertise, he has won the National Stock Trading Competition '18.