Trump Raises Tariff Tensions: EU Sounds Alarm as 30% Duties on EU and Mexico Spark Inflation Concerns

Summary

The latest threat of tariffs from US President Donald Trump has heightened concerns about inflation and trade disruptions. Trump has signaled a willingness to go to extreme lengths to shrink America’s trade deficits, reshore manufacturing, and coerce neighbors to curb the flow of fentanyl into the country. But allies don’t see it that way.

On Saturday, Trump announced he will impose a 30% tariff on all imports from the European Union (EU) and Mexico, effective August 1, 2025. Trump, a heavy social media user, delivered the threats via letters posted on his Truth Social account. The move comes after negotiations failed to materialize into a trade deal with either partner.

The EU has signaled it won’t back down easily. Immediately after the news broke, Maros Sefcovic, the EU Trade Commissioner, termed the threats “absolutely unacceptable.” The 27-nation bloc doesn’t seem ready to fold, although it is prepared to continue negotiating. On July 17, Sefcovic stressed that a 30% US tariff “practically prohibits” normal transatlantic trade and urged a last-minute compromise. In the meantime, EU officials have drawn up a retaliatory tariff list covering roughly €72 billion ($83.65 billion) of US imports.

Mexico wants to keep negotiating too, but said it won’t compromise its sovereignty in the face of an “unfair deal.” Mexican President Claudia Sheinbaum rejected Trump’s criticism over her efforts on border security and fentanyl, saying that she remained confident ongoing talks would yield a better, mutually acceptable deal.

Tariffs are Trump’s Playbook

The current tariff threats aren’t a one-off; they fit a pattern of Trump’s economic nationalism. During his first stint at the White House, between 2017 and 2021, Trump targeted China and others with various levies. The China-specific tariffs were especially punitive, sparking a storm of trade wars. Mexico and Canada were also targeted, which resulted in the North American Free Trade Agreement (NAFTA) being replaced by the United States–Mexico–Canada Agreement (USMCA) in 2020.

If anything, Trump’s second term is an escalation in tariff scope and ambition. Between February and March 2025, the administration slapped imports from Canada, Mexico, and China with various border taxes. Canadian energy exports received a 10% levy, 10% on Chinese goods, and 25% on Mexican and Canadian imports. The move escalated on what the White House called “Liberation Day.” In April, Trump’s administration imposed a 10% universal levy on all imports, with higher rates for countries with larger trade deficits. Only USMCA-compliant goods were exempted.

Trump’s tariff playbook has a singular objective: forcing concessions. However, experts warn that this strategy may not be working as intended. A Council on Foreign Relations (CFR) analysis indicates that not much has been achieved since Liberation Day. CFR found that the trade policy has failed to secure meaningful deals. Instead, countries like China have weathered tariffs, manufacturing reshoring hasn’t happened at the intended scale, and discriminatory trade barriers remain largely in place. The only wins that CFR identified are temporary revenue spikes and Panama curbing Chinese stakes in infrastructure near the canal.

The market too thinks this policy is a tool whose direction isn’t quite clear. Deutsche Bank analysts captured this sentiment quite aptly in a recent note. “To be fair, a month ago Trump threatened the EU with a 50% tariff, so you might argue this is an improvement! The market will generally think this is mostly a negotiating tactic and that we’re unlikely to see such rates,” they wrote.

The inflation backdrop raises more questions about this policy.

Tariffs Create Inflation Heat

Basically, inflation is when everyday purchases, such as a cup of coffee, get costlier. A 2019 working paper by three National Bureau of Economic Research (NBER) researchers found that Trump’s 2018 tariffs (25% on steel, 10% on aluminum) raised US consumer prices by $300–$1,000 per household annually. More recently, the Yale Budget Lab estimates that the 2025 tariffs (with an effective rate of 11.6%) could generate $1.7–$2.5 trillion in revenue but increase prices for 18–20% of EU imports.

This reality has prompted the market to price in a strong possibility of inflation continuing on a rising trajectory. These concerns are not misplaced either. On Tuesday, July 15, the Bureau of Labor Statistics released June’s consumer price index (CPI) reading, and the numbers show an uptick in inflation. The overall CPI for June increased 2.7% year-over-year, against 2.4% for May, while the month-over-month reading increased 0.3% versus a 0.1% increase in May.

Reactions from expert observers and commentators underscore the inflation concerns. Barron’s notes that inflation in America is on the rise, and this is only the beginning. eToro’s Bret Kenwell, on the other hand, wrote that June’s CPI reading “all but dashes any remaining hopes” of the possibility of a rate cut by the Federal Reserve at the next meeting. For Jeff Roach, chief economist for LPL Financial, “Inflation pressure will likely remain acute for the rest of the summer. Tariffs have not materially impacted inflation metrics yet, so we should expect some further pressure in the coming months.”

Roach’s analysis pinpoints the market’s inflation expectations. At the start of the year, the market’s expectation of where inflation will be in one to two decades from now was 2.4% (as of January). That figure is now lower at 2.3% (as of July), which indicates the market’s expectation of longer-term inflation is elevated.

But with Trump’s aggressive tariffs, Principal Asset Management’s Seema Shah sees the possibility of even higher inflation expectations. “Tariffs typically take several months to feed through to inflation data, while the significant front loading of imports implies that few goods may have been subject to tariffs yet,” Shah wrote.

If rising tariff tensions continue to impact inflation, Trump’s ire at the Fed Chair Jerome Powell will only grow. The president has recently expressed anger against Powell for the Fed Chair’s refusal to cut interest rates to Trump’s preferred levels. The tiff is so nasty that reports indicate Trump may oust Powell.

But Trump and Powell’s feelings aside, the majority of the market doesn’t expect a rate cut in September, particularly after Tuesday’s inflation data. A month before the data (on June 16), odds of a quarter rate cut were 14.4%, according to the CME Group’s FedWatch Tool. The odds fell to 2.1% on the day the BLS released June CPI data.

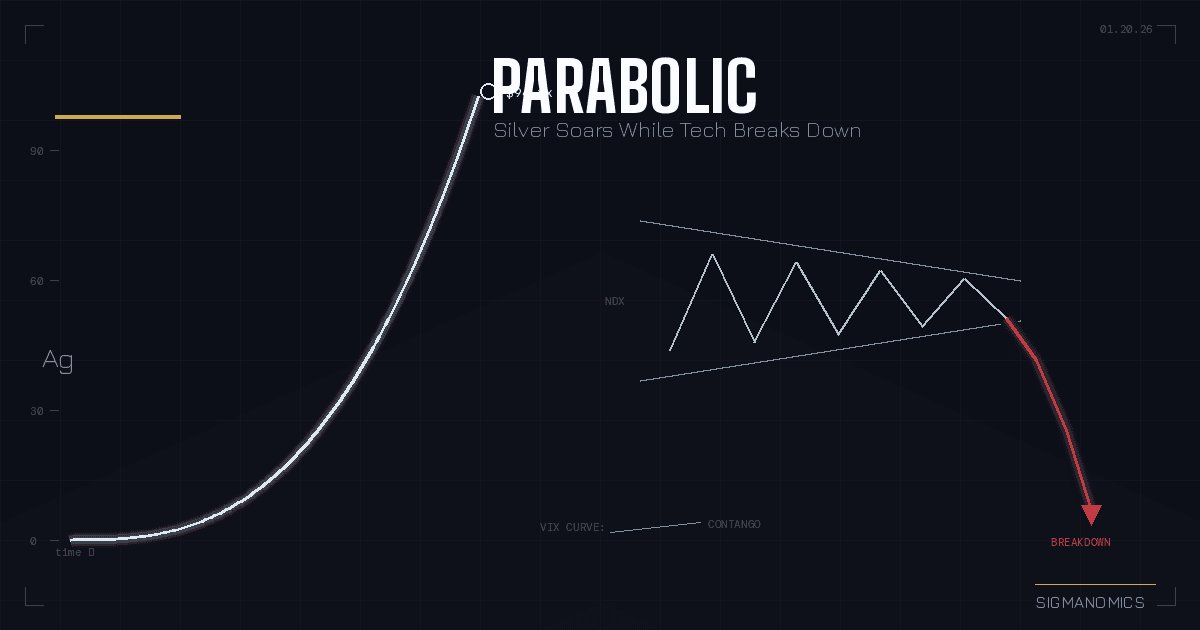

Market Reaction

As expected, markets opened on Monday, July 14, mutedly. The SPDR S&P 500 ETF Trust dipped slightly in intraday trading, sliding from $623.04 (Friday close) to $621.12 intraday. However, investors quickly shrugged off the tariff threats, pushing the ETF to close higher than on Friday, at $624.60.

Similarly, the Nasdaq Composite opened lower on Monday but quickly pared the losses. The index went on to touch new record highs in intraday trading on Tuesday. Nasdaq was up 0.46% over the past five days at writing.

At the same time, CNN’s Fear & Greed Index indicates that greed is driving the US market. In other words, investors are quite highly optimistic and are in the mood for higher-risk assets.

Analysts have an explanation for the muted response. According to Dan Coatsworth, an analyst at AJ Bell Investment, investors are expecting Trump to back down from the latest tariff threats through negotiations before the deadline. Coatsworth noted that Trump “has chickened out” before, and investors see this happening again.

“By now, investors know the drill: A lot will change between today and August 1, and the numbers thrown around at the moment are so high that they are ridiculous,” noted Panmure Liberum’s analysts.

Neha Gupta

Neha Gupta is a Chartered Financial Analyst with over 18 years of experience in finance and more than 11 years as a financial writer. She’s authored for clients worldwide, including platforms like MarketWatch, TipRanks, InsiderMonkey, and Seeking Alpha. Her work is known for its technical rigor, clear communication, and compliance-awareness—evident in her success enhancing market updates.