Wall Street’s Reluctant Rally: How Big Tech and AI Keep Driving Stocks Higher

Equity Indexes Are Back At All-Time Highs

At the midpoint of 2025, U.S. equity indexes are trading broadly in line with analysts’ forecasts, which had predicted that Donald Trump’s election victory would push markets to new highs this year. Goldman Sachs, RBC Capital Markets, Bank of America, Deutsche Bank, and Yardeni Research all set year-end targets for the S&P 500 Index between 6,500 and 7,000.

As of July 10, the large-cap index is already approaching the lower end of that range, hitting an all-time high of 6,280.46. The technology-heavy Nasdaq Composite Index has also set new records, climbing to 20,630.66.

What few forecasters saw coming, however, was that these record highs would follow the steepest market sell-off since the Covid-19 pandemic, wiping out $11 trillion in market value during President Trump’s first 100 days in office.

Fundstrat Global Advisors’ Tom Lee has called the rebound the “most hated V-shaped recovery,” as it defied expectations and sidelined many professional traders who had bet on further declines.

“The market’s recovery has been historic,” wrote The Kobeissi Letter, a market commentator, which noted that the S&P 500 Index added $11.4 trillion in market capitalization since its early April low. As a result, the index’s combined market cap hit a record $55.7 trillion.

Stepping back, several forces are driving the rally, including the sustained dominance of the tech sector, strong earnings momentum, expectations for monetary policy easing, and growing confidence that AI-driven productivity gains will help offset broader macroeconomic concerns. As a result, investors have largely brushed aside long-term fiscal risks, even as the bond market continues to warn of the need for greater fiscal discipline.

Dissecting the Rally

The information technology sector continues to wield outsized influence over the U.S. stock market. Strategist Charlie Bilello notes that the Technology Select Sector SPDR Fund (XLK) has surged 43% from its April low—significantly outpacing every other sector.

Tech’s dominance is also evident in flows into U.S. equity exchange-traded funds (ETFs). According to State Street, technology ETFs attracted $7.95 billion in inflows between January and June—more than double the amount for the next-largest sector, utilities. In contrast, energy, materials, healthcare, financials, consumer discretionary, and consumer staples ETFs all recorded net outflows year to date.

Morgan Stanley’s CIO of Portfolio Solutions, Jim Caron, recently noted that the S&P 500 continues to benefit from Big Tech’s dominance and the momentum behind the artificial intelligence boom. “Investors are betting that AI-driven productivity will boost earnings and help offset broader macro concerns,” Caron said.

That optimism is echoed by JPMorgan’s Private Bank Group, which noted in the first quarter that “AI will catalyze substantial productivity gains for businesses, consumers, and the economy as a whole.”

“Economic history is replete with examples of technologies that enabled adoption after costs declined dramatically,” JPMorgan added.

Caron also commented on how investors have managed to look past the many macro risks facing the U.S. economy—from tariff uncertainty and elevated interest rates to the growing fiscal burden of severe deficit spending.

One key factor has been stronger-than-expected corporate earnings in recent quarters. “Even if macro risks look, companies have kept margins solid and guidance higher, reassuring investors that fundamentals remain intact,” Caron said.

According to financial data provider FactSet, 78% of S&P 500 companies beat earnings estimates in the first quarter, with the index posting a blended earnings growth rate of 12.9%—the second straight quarter of double-digit gains.

While earnings growth is expected to moderate in the second quarter, FactSet still projects an S&P 500 growth rate of 5%.

The market recovery has also been supported by growing expectations that the Federal Reserve will finally resume cutting interest rates after holding steady since the start of the year.

“Markets are pricing in Fed rate cuts starting later this year, which supports equity valuations,” Caron said. “Lower rates reduce discount rates on future cash flows, making stocks, especially growth stocks, look more attractive.”

Goldman Sachs shares a similar view, recently moving up its timeline for Fed cuts to September. Economists led by David Mercier now expect 25 basis-point cuts at three consecutive meetings in September, October, and December.

“If there is any insurance motive for cutting, it would be most natural to cut at consecutive meetings,” Mercile said.

Fed funds futures currently imply a nearly 70% chance of a rate cut in September, according to CME Group. By December, the probability that the federal funds rate will remain unchanged drops to less than 3%, indicating that investors widely expect policymakers to start easing soon.

Expectations could shift after the Fed’s September meeting, which often carries extra weight as it follows the Jackson Hole Symposium and includes updated quarterly economic projections heading into a crucial seasonal period for equities.

Market Reaction

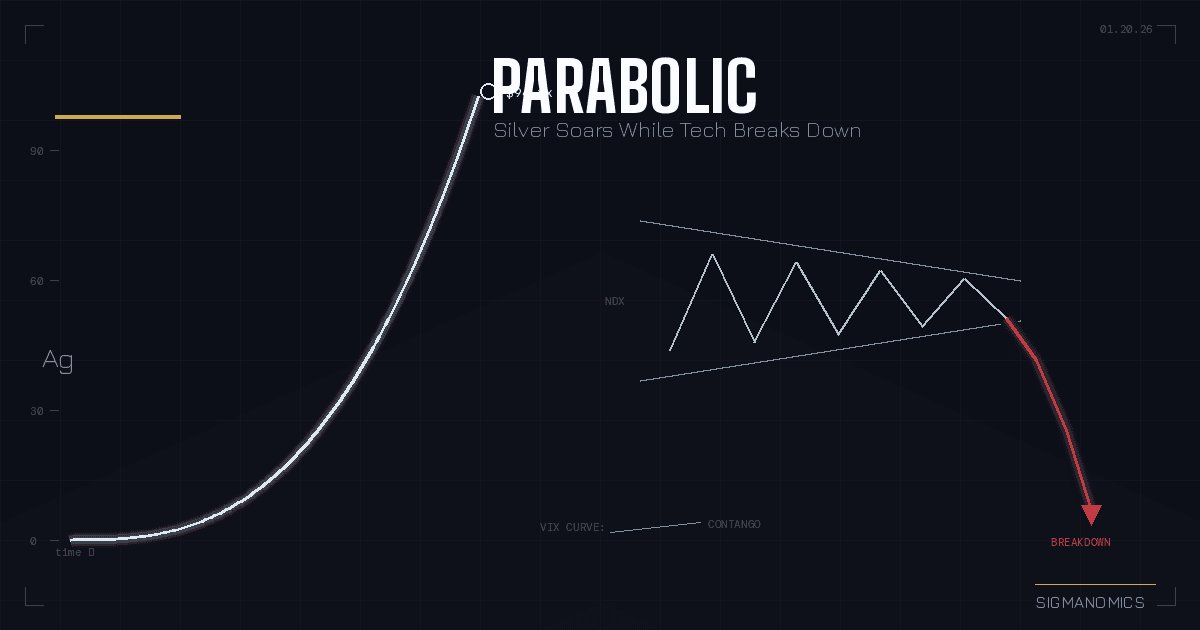

SPY Daily Chart Sigmanomics, All rights reserved

Since hitting their lows in April, the Dow Jones Industrial Average, S&P 500 Index, and Nasdaq Composite Index have climbed 18%, 26%, and 35%, respectively, pushing all three benchmarks into positive territory for the year.

The rally has come alongside a sharp drop in market volatility, with the CBOE VIX down more than 70% and now trading below its long-term average. Wall Street’s so-called “fear index” has swung wildly this year, reflecting the market’s dramatic reversals. But its steady decline since April suggests that investors are growing more confident that the worst of the turbulence is behind them.

While analysts remain divided on whether the market can sustain this momentum, Morgan Stanley’s economics team believes that multiple rate cuts will help support equity valuations in the second half of the year.

“Our work shows equity performance is strong during Fed cutting cycles even if this tailwind starts to get discounted ahead of time,” Morgan Stanley’s strategists, led by Mike Wilson, wrote in a note to clients.

Wilson’s team has raised its S&P 500 price targets since the index returned to record highs, noting that the rally is “more fundamentally driven than many appreciate.” If they’re right, the bullish momentum could extend for another six to twelve months as earnings tailwinds continue to build.