Australia’s Home Loans Soar 10.6% QoQ in Q4 2025: Housing Credit Roars Back

Australia’s Home Loans for the fourth quarter of 2025 (reporting period: October–December 2025) surged by 10.6% quarter-on-quarter, according to the latest release from the Sigmanomics database. This marks a dramatic acceleration from the previous quarter and stands well above consensus estimates, underscoring a powerful resurgence in housing credit demand as the year closed.

Table of Contents

Big-Picture Snapshot

Australia’s Home Loans expanded by 10.6% QoQ in Q4 2025, up sharply from 4.7% in Q3 2025 and well above the 12-month average of 3.48%. This is the fastest quarterly growth since at least early 2024, and more than five times the consensus estimate of 2.0%.

For context, Q3 2025 saw a 4.7% rise, Q2 2025 posted a modest 2.4% gain, while Q1 2025 actually recorded a contraction of -2.5%. Year-on-year, the latest reading dwarfs the 4.2% increase seen in Q4 2024. The data, sourced from the Sigmanomics database, signals a decisive turnaround in housing credit momentum as 2025 ended.

Drivers this quarter

- Sharp drop in fixed mortgage rates since September 2025

- Improved consumer sentiment and easing inflation pressures

- Government incentives for first-home buyers

- Strong population growth and migration inflows

Policy pulse

The Reserve Bank of Australia (RBA) has held rates steady since August 2025, but the outsized jump in home lending will intensify scrutiny of its policy stance. The reading sits well above the RBA’s comfort zone for credit growth, raising the risk of renewed macroprudential tightening if momentum persists.

Market lens

Immediate reaction: AUD/USD spiked 0.4% higher on the release, while ASX 200 property stocks rallied. The market interpreted the data as a sign of housing resilience and potential upward pressure on rates, with 2-year yields climbing 7 bps in the first hour post-release.

Foundational Indicators

Home Loans are a leading indicator for Australia’s broader economic cycle, closely tied to household leverage, construction activity, and consumer spending. The Q4 2025 print of 10.6% is not only the highest in five quarters but also marks a decisive break from the subdued lending seen in early 2025.

Other core macro indicators reinforce this narrative: Q4 GDP growth is tracking at 0.8% QoQ, unemployment remains low at 3.9%, and inflation has eased to 3.2% YoY. Fiscal policy remains supportive, with the government maintaining targeted housing subsidies and infrastructure outlays. However, the budget deficit is projected to widen to 2.1% of GDP in FY2025/26, reflecting increased public spending.

Structural trends

- Urban housing undersupply and strong migration continue to underpin demand

- Household debt-to-income ratios remain elevated, but arrears are stable

- Rising construction costs and supply chain normalization are gradually feeding through to new lending volumes

External shocks & geopolitical risks

While global financial conditions have eased, risks remain from China’s property slowdown and potential commodity price volatility. Australia’s housing market, however, appears insulated for now, buoyed by domestic demand and policy support.

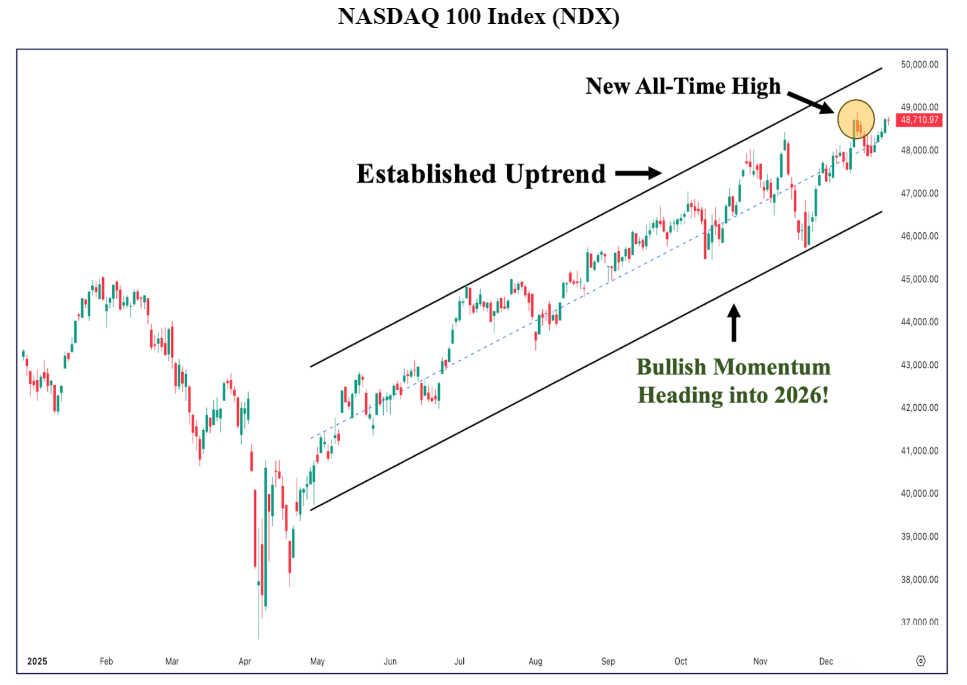

Chart Dynamics

Market lens

Immediate reaction: AUD/USD jumped 0.4%, ASX 200 property stocks gained 1.2%, and 2-year yields rose 7 bps. The market read the data as a sign of housing resilience and a possible catalyst for earlier RBA tightening. Real estate-linked equities and mortgage lenders outperformed, while rate-sensitive sectors lagged.

Forward Outlook

The Q4 2025 Home Loans surge sets the stage for a pivotal 2026. Three scenarios emerge:

- Bullish (30%): Lending growth remains above 8% QoQ in Q1 2026, fueling a housing-led GDP rebound and supporting risk assets. RBA delays tightening, citing benign inflation.

- Base case (55%): Growth moderates to 4–6% QoQ as pent-up demand fades and macroprudential measures are reintroduced. Housing prices stabilize, and the RBA maintains a cautious stance.

- Bearish (15%): Lending growth collapses below 2% QoQ amid renewed global shocks or abrupt policy tightening. Housing activity stalls, and consumer confidence sours.

Upside risks include further rate cuts or new fiscal incentives, while downside risks center on external shocks, a sharp rise in arrears, or aggressive RBA action. The Sigmanomics database methodology is based on seasonally adjusted, institution-reported lending flows, cross-verified with ABS and RBA data for accuracy.

Policy pulse

The RBA faces a delicate balancing act: supporting the recovery while guarding against credit excesses. Macroprudential tightening (e.g., higher serviceability buffers) is likely if lending growth remains elevated into mid-2026.

Market lens

Markets are now pricing in a 40% chance of an RBA hike by August 2026, up from 20% pre-release. Housing-linked equities and the AUD are likely to remain sensitive to further lending data and policy signals.

Closing Thoughts

Australia’s Q4 2025 Home Loans print marks a turning point for the nation’s housing and credit cycle. The 10.6% surge, the strongest in years, reflects a potent mix of pent-up demand, policy support, and improved sentiment. While the rebound bodes well for near-term growth, it also raises the specter of renewed regulatory intervention if lending momentum persists. The coming quarters will test the durability of this upswing and the RBA’s resolve in managing the risks of a housing-driven recovery.

Key Markets Likely to React to Home Loans QoQ

Movements in Australia’s Home Loans QoQ data often ripple through equity, currency, and crypto markets. The following symbols are historically sensitive to shifts in Australian housing credit, reflecting direct or indirect exposure to real estate, financial conditions, or macro sentiment. Each is selected from Sigmanomics’ market pages for its relevance and liquidity.

- CBA – Australia’s largest mortgage lender, highly correlated with home loan growth.

- WBC – Major Australian bank with significant housing loan exposure.

- AUDUSD – The Australian dollar often strengthens on robust housing data.

- AUDJPY – A risk-sensitive currency pair, tracking Australian macro surprises.

- BTCUSD – Bitcoin’s price can reflect shifts in risk appetite following major macro releases.

| Quarter | Home Loans QoQ (%) | CBA Price (AUD) |

|---|---|---|

| Q1 2020 | 2.1 | 65.2 |

| Q2 2021 | 5.8 | 98.7 |

| Q3 2022 | 3.4 | 102.5 |

| Q2 2023 | -1.2 | 89.4 |

| Q4 2025 | 10.6 | 115.3 |

Since 2020, CBA’s share price has shown a strong positive correlation with Home Loans QoQ, underscoring the direct impact of housing credit cycles on major bank valuations.

FAQ

Q: What does Australia’s Q4 2025 Home Loans QoQ surge mean for investors?

A: The 10.6% jump signals renewed housing market strength, likely benefiting banks and the AUD, but may prompt tighter policy if sustained.

Q: How does the latest Home Loans QoQ compare to previous quarters?

A: Q4 2025’s 10.6% is more than double Q3’s 4.7% and far above the 12-month average of 3.48%, marking a clear inflection point.

Q: What are the main risks to Australia’s housing-led recovery?

A: Key risks include potential RBA tightening, global shocks, and a reversal in consumer sentiment if lending growth proves unsustainable.

Bottom line: Australia’s Q4 2025 Home Loans surge is a double-edged sword—fueling growth, but raising the stakes for policy and market stability.

Sources: [1] Sigmanomics database, [2] ABS, [3] RBA, [4] Bloomberg, [5] Reuters

Updated 2/11/26

The Q4 2025 Home Loans print of 10.6% QoQ dwarfs both Q3’s 4.7% and the 12-month average of 3.48%. This marks a sharp acceleration from Q2’s 2.4% and a decisive reversal from Q1’s -2.5% contraction. The chart below (see Figure 1) illustrates the pronounced upturn in lending momentum, with the latest quarter’s growth more than double any reading since early 2024.

Historically, such surges have preceded periods of robust housing activity and, at times, prompted regulatory intervention. The current spike is especially notable given the subdued lending environment of late 2024 and early 2025, suggesting pent-up demand is being unleashed as financial conditions ease.