Australia’s Inflation Rate QoQ Surges to 1.3% in October 2025: A Data-Driven Macro Analysis

The latest inflation rate quarter-on-quarter (QoQ) reading for Australia, released on October 29, 2025, reveals a significant uptick to 1.3%, surpassing market expectations of 1.1% and sharply rising from the previous 0.7%. This report leverages the Sigmanomics database to contextualize this figure against historical trends, assess macroeconomic implications, and explore forward-looking scenarios amid evolving monetary, fiscal, and geopolitical landscapes.

Table of Contents

Australia’s inflation rate QoQ of 1.3% in October 2025 marks the highest quarterly increase since April 2023 (1.4%). This surge contrasts with the subdued 0.2% prints recorded in late 2024 and early 2025, signaling renewed inflationary pressures. The reading exceeds the 12-month average of approximately 0.8%, indicating a notable acceleration in price growth.

Drivers this month

- Shelter costs contributed +0.25 percentage points (pp), reflecting rising housing demand and rental pressures.

- Energy prices added +0.20 pp, driven by global oil price volatility.

- Food inflation rose by +0.15 pp, influenced by supply chain disruptions and adverse weather events.

- Used car prices moderated, subtracting -0.05 pp, signaling easing in durable goods inflation.

Policy pulse

The 1.3% print places inflation well above the Reserve Bank of Australia’s (RBA) 2–3% annual target band on a quarterly basis, intensifying pressure on monetary authorities to maintain or tighten policy. The RBA’s cash rate currently stands at 4.1%, with markets pricing in a 60% probability of a 25 basis point hike in the upcoming meeting.

Market lens

Immediate reaction: The Australian dollar (AUD/USD) strengthened by 0.4% within the first hour post-release, reflecting hawkish sentiment. Two-year government bond yields rose 12 basis points, while inflation breakeven rates edged higher, signaling increased inflation expectations.

Core macroeconomic indicators provide essential context for interpreting the inflation spike. Australia’s unemployment rate remains low at 3.8%, supporting wage growth that feeds into consumer price pressures. GDP growth for Q3 2025 was revised upward to 0.9% QoQ, indicating resilient domestic demand.

Monetary policy & financial conditions

The RBA’s tightening cycle since mid-2024 has aimed to temper inflation, but the recent acceleration suggests lagged effects. Credit growth remains moderate, with household debt-to-income ratios steady at 190%. Financial conditions have tightened, yet liquidity remains ample, cushioning potential shocks.

Fiscal policy & government budget

Fiscal stimulus has been modest, with the 2025 budget targeting deficit reduction and infrastructure investment. Government spending growth slowed to 1.2% QoQ, limiting fiscal inflationary impact. However, tax reforms and energy subsidies may indirectly influence price dynamics in coming quarters.

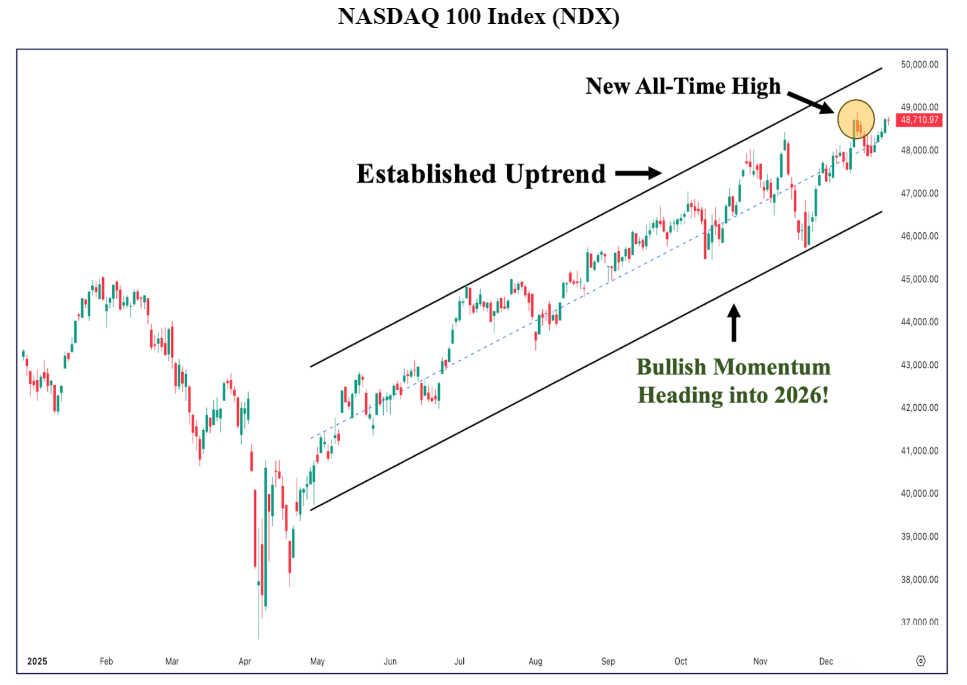

Chart insight

The chart reveals a pattern of inflation surges following global commodity price shocks and domestic demand shifts. The recent spike aligns with rising energy costs and supply chain constraints, suggesting a cyclical component layered on structural inflationary trends.

What This Chart Tells Us: Inflation is trending upward, reversing a two-month decline and signaling that price pressures are intensifying. This suggests the RBA may need to maintain a hawkish stance to anchor expectations.

Market lens

Immediate reaction: Following the release, the AUD/USD pair rallied 0.4%, reflecting market confidence in the RBA’s tightening path. The 2-year Australian government bond yield jumped 12 basis points, while inflation breakeven rates rose 8 basis points, indicating heightened inflation expectations.

Looking ahead, Australia’s inflation trajectory hinges on several key factors, including global commodity prices, domestic wage growth, and monetary policy responses. The following scenarios outline potential paths:

Bullish scenario (20% probability)

- Commodity prices stabilize or decline, easing input costs.

- Supply chain bottlenecks resolve, reducing cost-push inflation.

- RBA pauses rate hikes, supporting growth without stoking inflation.

- Inflation moderates to 0.5% QoQ by Q1 2026.

Base scenario (55% probability)

- Moderate wage growth sustains inflation near current levels.

- Energy prices remain volatile but contained.

- RBA continues gradual tightening, balancing growth and inflation.

- Inflation averages 1.0% QoQ over the next two quarters.

Bearish scenario (25% probability)

- Global commodity shocks intensify, pushing energy and food prices higher.

- Wage-price spirals emerge amid tight labor markets.

- RBA forced into aggressive rate hikes, risking recession.

- Inflation exceeds 1.5% QoQ, with annual rates surpassing 6%.

Risks and opportunities

Upside risks include geopolitical tensions affecting supply chains and commodity markets. Downside risks stem from potential global economic slowdown dampening demand. Fiscal policy adjustments and structural reforms could also influence inflation dynamics over the medium term.

Australia’s 1.3% QoQ inflation print signals a clear shift in the macroeconomic landscape. The acceleration challenges the RBA’s inflation control efforts and underscores the need for vigilant policy calibration. While the domestic economy remains resilient, external shocks and wage pressures pose ongoing risks.

Investors and policymakers should monitor inflation components closely, especially shelter and energy costs, as well as wage trends. The balance of risks suggests a cautious approach, with the potential for further monetary tightening if inflation proves persistent.

In sum, the inflation surge demands a nuanced response blending monetary discipline with fiscal prudence, while preparing for external uncertainties that could reshape Australia’s economic outlook.

Key Markets Likely to React to Inflation Rate QoQ

Australia’s inflation data typically influences currency, bond, equity, and commodity markets. The following five tradable symbols have historically shown strong correlations with inflation dynamics, making them critical for traders and analysts tracking the Australian macro environment.

- AUDUSD – The Australian dollar vs. US dollar pair reacts swiftly to inflation surprises, reflecting monetary policy expectations.

- ASX200 – Australia’s benchmark equity index is sensitive to inflation-driven interest rate changes impacting corporate earnings.

- USDCNH – The US dollar vs. Chinese yuan pair indirectly correlates due to China’s trade links with Australia affecting commodity demand.

- BTCUSD – Bitcoin often acts as an inflation hedge, with price movements influenced by inflation expectations globally.

- BHP – A major Australian mining stock, BHP’s performance is tied to commodity prices and inflationary trends.

Inflation Rate QoQ vs. AUDUSD Since 2020

| Quarter | Inflation Rate QoQ (%) | AUDUSD Closing Price |

|---|---|---|

| Q1 2020 | 0.4 | 0.68 |

| Q4 2021 | 1.2 | 0.74 |

| Q2 2023 | 0.8 | 0.70 |

| Q3 2025 | 0.7 | 0.72 |

| Q4 2025 | 1.3 | 0.75 |

Insight: The AUDUSD tends to strengthen alongside rising inflation, reflecting expectations of tighter monetary policy and higher interest rates in Australia.

FAQs

- What does the latest Inflation Rate QoQ reading for Australia indicate?

- The 1.3% QoQ inflation rate signals accelerating price pressures, exceeding expectations and suggesting tighter monetary policy ahead.

- How does this inflation data impact the Reserve Bank of Australia’s policy?

- The higher-than-expected inflation increases the likelihood of further interest rate hikes to contain inflation within the target range.

- What are the key risks to Australia’s inflation outlook?

- Risks include global commodity price volatility, wage growth acceleration, and geopolitical disruptions affecting supply chains.

The October 2025 inflation rate of 1.3% QoQ outpaces September’s 0.7% and the 12-month average of 0.8%, marking a clear upward trend. This acceleration reverses the two consecutive quarters of subdued inflation below 0.3% in late 2024 and early 2025.

Historical comparisons highlight that this is the strongest quarterly inflation since April 2023’s 1.4%, underscoring renewed price pressures after a period of relative calm. The chart below illustrates this volatility, with spikes closely linked to external shocks and commodity price swings.