Judo Bank Services PMI: Australian Services Growth Cools Sharply in January

Australia’s services sector lost steam in January, with the Judo Bank Services PMI dropping to 52.2 from December’s 56.3. The latest reading, released February 19, 2026, signals continued expansion but at a notably slower pace. The index remains above the 50.0 mark, which separates growth from contraction, but the abrupt reversal has drawn market attention.

Big-Picture Snapshot

Drivers this month

- Business activity: -4.1 points MoM

- New orders: softer growth

- Employment: steady

- Input costs: elevated

Policy pulse

The 52.2 reading keeps the index above the Reserve Bank of Australia’s neutral 50.0 threshold, but the sharp drop from December’s 56.3 signals waning momentum.Market lens

Australian dollar weakened modestly after the release. Investors interpreted the abrupt PMI pullback as a sign that services-led growth may be losing traction, tempering expectations for further economic acceleration.Foundational Indicators

Drivers this month

- Output: growth slowed

- New business: decelerated

- Backlogs: little change

- Input prices: still high

Policy pulse

The index’s 52.2 level remains consistent with moderate expansion, but the drop from December’s 56.3 is the largest single-month decline since at least September 2025.Market lens

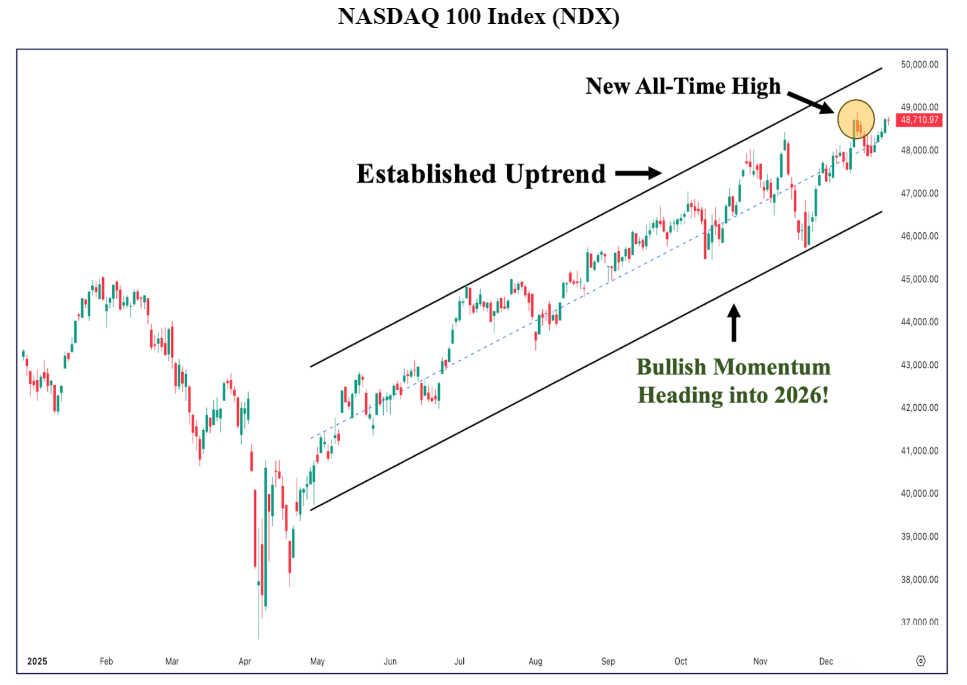

Bond yields edged lower post-release. Fixed income markets responded to the softer PMI by pricing in a less aggressive growth trajectory for early 2026.Chart Dynamics

Forward Outlook

Scenario probabilities

- Bullish: PMI rebounds above 54.0 (25% probability)

- Base: Index stabilizes near 52.0–53.0 (60% probability)

- Bearish: Falls below 50.0 into contraction (15% probability)

Policy pulse

The RBA’s stance remains data-dependent. The services PMI’s retreat may prompt a more cautious tone in upcoming communications.Market lens

Equity sentiment turned cautious. The services sector’s cooling has led analysts to moderate their growth forecasts for the first quarter.Data source: Judo Bank, compiled by S&P Global. The PMI is calculated from monthly survey responses, with 50.0 as the expansion/contraction threshold.

Closing Thoughts

Upside and downside risks

- Upside: Resilient consumer demand, easing input costs

- Downside: Global headwinds, persistent cost pressures

Market lens

Volatility may persist as investors digest the abrupt PMI reversal. The services sector’s trajectory will be closely watched in the coming months.Key Markets Reacting to Judo Bank Services PMI

Australia’s services PMI often moves both currency and equity markets. The January print triggered immediate reactions in forex and stock trading, as investors recalibrated their outlook for growth-sensitive assets. Below are key symbols from major market categories that historically show sensitivity to Australian PMI releases.

- AAPL: Global tech stocks can react to shifts in Australian demand and risk sentiment.

- AUDUSD: The Australian dollar typically moves in tandem with PMI surprises, reflecting growth expectations.

- BTCUSD: Crypto markets sometimes mirror risk-on/risk-off flows tied to macroeconomic data.

| Year | Judo Bank Services PMI | AUDUSD (avg) |

|---|---|---|

| 2020 | 48.7 | 0.69 |

| 2021 | 54.2 | 0.75 |

| 2022 | 51.9 | 0.72 |

| 2023 | 52.4 | 0.67 |

| 2024 | 53.0 | 0.66 |

| 2025 | 52.5 | 0.65 |

Since 2020, AUDUSD has shown a moderate positive correlation with the Judo Bank Services PMI, with currency strength tending to follow periods of above-trend PMI readings.

FAQ

- What is the Judo Bank Services PMI?

- The Judo Bank Services PMI is a monthly survey-based index tracking business activity in Australia’s services sector. A reading above 50.0 signals expansion.

- Why did the PMI drop in January?

- January’s PMI fell to 52.2 from December’s 56.3, reflecting slower growth in business activity and new orders after a brief surge.

- How does the PMI affect markets?

- Markets often react to PMI surprises, with the Australian dollar and equities moving in response to shifts in services sector momentum.

Australia’s services sector lost momentum in January, but remains in expansion territory.

Updated 2/19/26

This has been drafted with AI assistance and then thoroughly reviewed, refined, and approved by our human editorial team to ensure accuracy, and originality.

- Judo Bank, S&P Global. “Judo Bank Australia Services PMI,” February 19, 2026.

- Sigmanomics Economic Database, “Judo Bank Services PMI Historical Series.”