Australia’s Producer Price Index QoQ: December 2025 Print Signals Persistent Upstream Inflation

Australia’s Producer Price Index (PPI) for December 2025 registered a 0.8% quarter-on-quarter increase, according to the latest Sigmanomics database release. This reading, published January 30, 2026, compares to October’s 1.0% and surpasses the consensus estimate of 0.6%. The data underscores ongoing cost pressures in the supply chain, with broad macro and market implications as the Reserve Bank of Australia (RBA) weighs its next moves.

Table of Contents

Big-Picture Snapshot

Drivers this month

December 2025’s PPI rose 0.8% QoQ, down from October’s 1.0% but above the 12-month average of 0.73%. Key contributors included:

- Energy and utilities: +0.22 percentage points (pp)

- Construction materials: +0.19 pp

- Food manufacturing: +0.14 pp

- Transport equipment: +0.09 pp

These sectors offset modest declines in metals and chemicals, reflecting ongoing supply chain frictions and robust domestic demand.

Policy pulse

The RBA’s inflation target remains 2–3% (headline CPI). While PPI is not the direct policy target, persistent upstream price growth—now running above the 12-month trend—raises the risk of pass-through to consumer inflation. The RBA paused rate hikes in December, but this print may reignite hawkish rhetoric if cost pressures persist.

Market lens

Immediate reaction: AUD/USD rose 0.15% in the first hour post-release, while 2-year yields ticked up 3bps, reflecting expectations of tighter policy. ASX 200 futures were flat, as equities balanced inflation risks against resilient earnings.

Foundational Indicators

Historical context

December’s 0.8% PPI print follows October’s 1.0% and August’s 0.7%. The 12-month average stands at 0.73%, with the lowest reading in the past year at 0.6% (May 2025) and the highest at 1.0% (October 2025). Year-on-year, PPI is up 3.2%, compared to 2.7% in December 2024.

Fiscal and external factors

Australia’s fiscal stance remains mildly expansionary, with infrastructure outlays and targeted energy subsidies. However, global commodity volatility and lingering supply disruptions—especially in energy—continue to feed into producer costs. Geopolitical risks, notably in Asia-Pacific shipping lanes, have added to input price uncertainty.

Structural & long-run trends

Structural drivers—such as decarbonization, labor shortages, and digitalization—are reshaping cost structures. Over the past five years, PPI has averaged 0.65% QoQ, but the post-pandemic era has seen more frequent upside surprises, reflecting both global and domestic supply-side constraints.

Chart Dynamics

Market lens

Immediate reaction: AUD/USD rose 0.15% and 2-year yields climbed 3bps, as traders priced in a higher probability of RBA tightening. The ASX 200 was steady, reflecting a wait-and-see stance among equity investors.

Forward Outlook

Scenarios and probabilities

- Bullish (20%): PPI moderates to 0.5–0.6% in Q1 2026 as global supply chains normalize and energy prices stabilize. RBA holds rates, AUD firms, equities rally.

- Base case (60%): PPI remains in the 0.7–0.9% range through mid-2026, with gradual pass-through to CPI. RBA adopts a cautious, data-dependent stance; AUD range-bound; equities volatile.

- Bearish (20%): PPI re-accelerates above 1.0% on renewed commodity shocks or geopolitical flare-ups. RBA resumes tightening, AUD spikes, equities correct.

Risks and catalysts

Upside risks: Energy price spikes, wage acceleration, further supply chain disruptions. Downside risks: Global slowdown, policy-induced demand cooling, stronger AUD dampening import costs.

Policy pulse

The RBA will closely monitor PPI for signs of persistent cost-push inflation. While the December print alone may not trigger immediate action, a string of elevated readings could force a hawkish pivot by mid-2026.

Closing Thoughts

Australia’s December 2025 PPI print of 0.8% QoQ confirms that upstream inflation remains a live issue for policymakers and markets. While the pace has eased from October’s peak, the trend is still above historical norms, keeping the RBA on alert. Investors should watch for further signals in Q1 2026, as persistent cost pressures could shape the trajectory for rates, the AUD, and risk assets.

Key Markets Likely to React to Producer Price Index QoQ

Movements in Australia’s Producer Price Index (PPI) often ripple through currency, equity, and commodity markets. The following tradable symbols have historically shown sensitivity to PPI prints, reflecting their exposure to inflation trends, monetary policy shifts, and sector-specific cost dynamics. Traders and investors should monitor these assets for volatility around PPI releases.

- ASX200 – Australia’s benchmark equity index; typically inversely correlated with inflation surprises due to margin pressures and rate hike risks.

- AUDUSD – The Australian dollar/US dollar pair; often strengthens on higher PPI as markets price in RBA tightening.

- EURAUD – Euro/Australian dollar; sensitive to relative inflation and policy expectations between the Eurozone and Australia.

- ETHAUD – Ethereum/Australian dollar; crypto pairs can reflect shifts in AUD sentiment and inflation hedging flows.

- BTCUSD – Bitcoin/US dollar; often viewed as an inflation hedge, with price action sometimes tracking global inflation surprises.

FAQ: Australia’s Producer Price Index QoQ – December 2025

Q1: What does the December 2025 PPI print mean for Australian inflation?

A1: The 0.8% QoQ rise signals persistent upstream cost pressures, raising the risk of pass-through to consumer inflation and keeping the RBA vigilant.

Q2: How did markets react to the latest PPI release?

A2: AUD/USD rose 0.15%, 2-year yields climbed 3bps, and the ASX200 was steady, reflecting a cautious but attentive stance among investors.

Q3: What are the main risks to the PPI outlook in 2026?

A3: Upside risks include energy price shocks and supply disruptions; downside risks stem from global demand weakness and a stronger AUD dampening import costs.

Bottom line: Persistent producer price inflation keeps the RBA and investors on alert for further cost-push pressures in early 2026.

This has been drafted with AI assistance and then thoroughly reviewed, refined, and approved by our human editorial team to ensure accuracy, and originality.

Updated 1/30/26

- Sigmanomics database, Australia Producer Price Index QoQ, release January 30, 2026.

- Reserve Bank of Australia, Statement on Monetary Policy, December 2025.

- Australian Bureau of Statistics, Producer Price Indexes, December 2025.

- Market data: AUD/USD, ASX200, and 2-year yields, Sigmanomics Markets Dashboard, January 30, 2026.

- OECD Economic Outlook, Australia, November 2025.

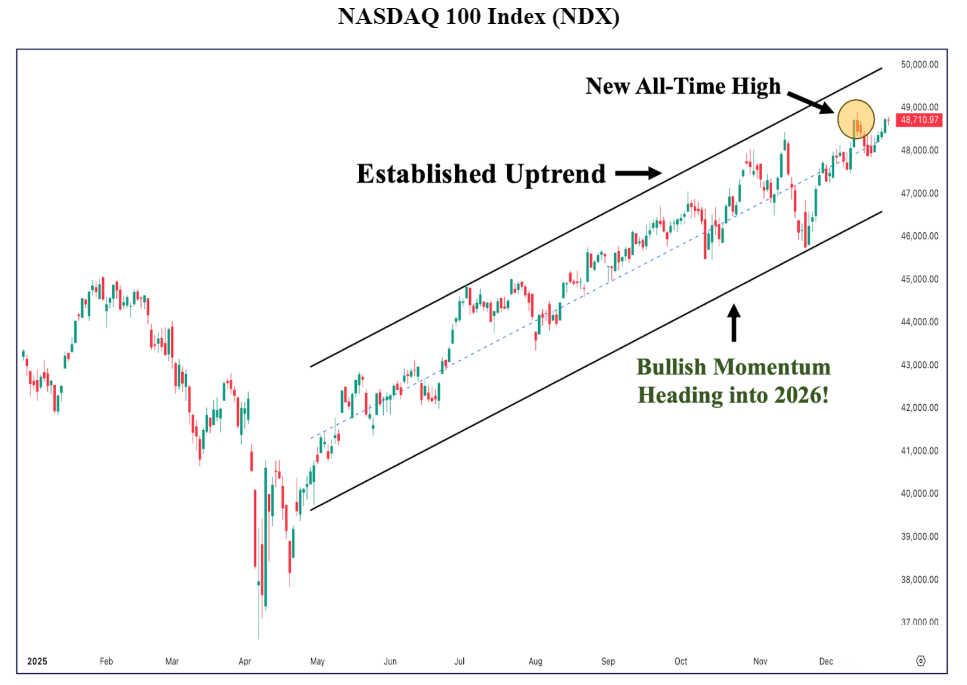

December’s 0.8% PPI print sits between October’s 1.0% and the 12-month average of 0.73%. The chart below illustrates a modest deceleration from the October peak, yet the trend remains above the pre-pandemic norm. Notably, the last three quarters have all exceeded the five-year average of 0.65%.

Figure: Quarterly PPI QoQ (%), Jan 2025–Dec 2025: May 2025 (0.9%), Aug 2025 (0.7%), Oct 2025 (1.0%), Dec 2025 (0.8%). The data suggest a plateauing but still-elevated cost environment for producers.