August Stock Market Analysis: Earnings Momentum and Technical Tailwinds Point to New Highs, But Ripples Loom

Overview

WallStreet feels remarkable upbeat as we crossover in to August 2025, lead by an earnings season that posted a fifth straight quarter of record-high profit margins (north of 15 percent). Even the most cautious strategists are revising their targets higher as the northbound train seems to be running on more fuel than most had previously thought was available to continue this upward momentum. For instance, Golman Sachs recently told its clients, “We’re revising our S&P 500 year-end call to 6,600 because of robust margins and AI-driven capital spending have lengthened the earnings runway.” Consensus also expects S&P 500 companies to earn about $282 a share this year which is more than double the pace of nominal GDP. In other words, corporate America is squeezing out more profit for every sales on the dollar than the macr economy due to three pillars:

1. Solid 3 percent U.S. GDP growth carried by AI-driven cap-ex boom

2. Simmering inflation as core consumer prices in June held at a manageable 2.8 percent as compared to the year prior.

3. Trade tariffs tango that recently saw U.S. and EU come to an agreement and remove cloud hanging ovefr multinationals.

Though the upbeat case still looms, pundits such as The Street remind us, “Inflation’s impact on consumer prices remainsthe key lever that decides whether the Fed actually gets room to ease.” So yes, the macro backdrop looks constructive; however, it is far from a slam dunk.

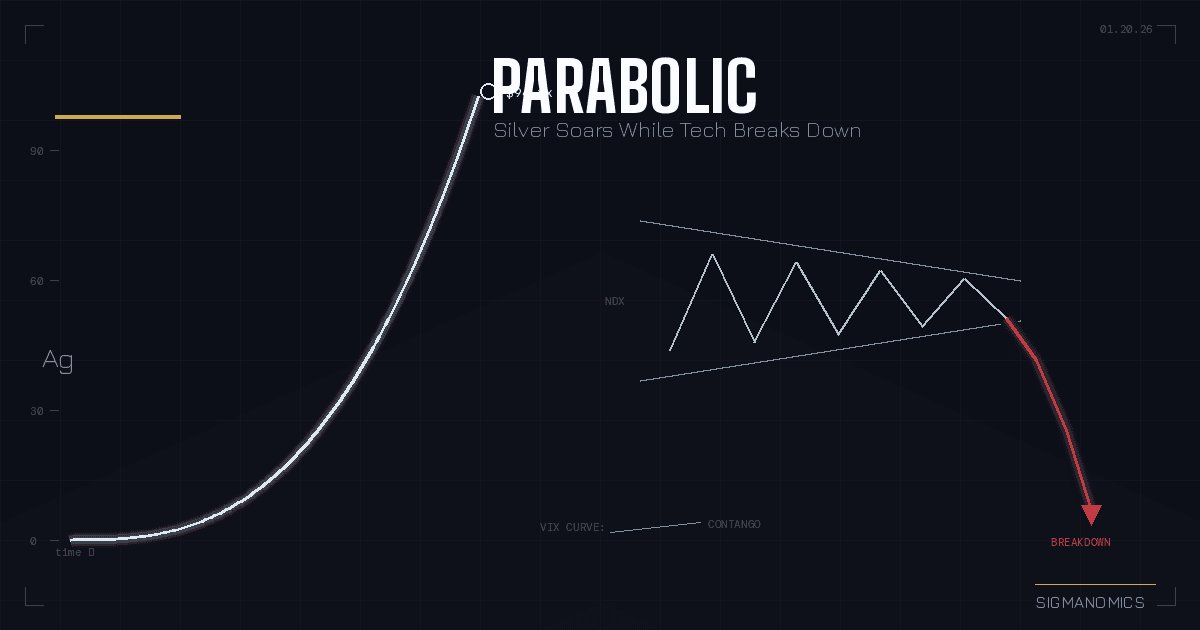

Reading the tape without the Jargon

Technical analysis is difficult to understand and follow on average; however, the story they’re telling at the moment is that the trend strength remains alive and well. Momentum gauges seemingly echo optimism. Our in-house Sig-O oscillator (blend of RSI and MACD) sits at +1.4, signaling strong trend territory. The Vix is around 14, while trading below its one-year average of 17, a sign that traders aren’t paying much to hedge. Of great importance is the 10 year treasury yield that has been stuck below a tough ceiling at 4.60 percent. A break above could drag mortgage and corporate borrowing rates higher and cause equity multiples to feel the blow. Until that happens, the technical landscape gives bulls the benefit of the doubt, with the caveat that August tends to dish out a shakeout.

Stock Highlights

Source: Sigmanomics.com

As portfolios live and die by stock selection, we will take a closer look at winners and losers of 2025 through July. The superstar of the year thus far is Nvidia, whose April-ended quarter released with a $44 billion in revenue – up 69 percent from the year prior. With shares nearly 30 percent above its 50-day moving average, along with implied volatility moving lower, option traders appear to be underestimating how far the next breakout could carry. Our technical analysts here at Sigmanomics.com suggest that $175 could print before Halloween if data-center demand stays red-hot.

Meanwhile, Apple has been lagging year to date; however, analysts still call for bullish scenarios with the mean target around $231, with the most bullish calls near $300.00. Not to overlook, Microsoft, Alphabet, and Amazon round out what we call the “picks-and-shovels” AI group. Outside of the technology sector, crude oil may surprise anyone who stopped watching the energy sector after 2022. Take for example, Goldman’s commodity desk thinks Brent could average $95 in the fourth quarter if the Middle-East shipping lanes stay tense. HSBC also recently said a spike to $110 is plausible. Taking both factors into account, companies such as Exxon, Chevron and the refiners – Phillips 66 and valero are attractive.